Advertisement|Remove ads.

Costco April Numbers Show Softening Demand: Retail Users Turn Bearish

Consumer demand at Costco Wholesale (COST), one of America's leading retailers of staple and value goods, is beginning to show signs of softening.

On Wednesday, Costco reported a 7% year-over-year increase in sales for April, reaching $21.2 billion — a modest slowdown from the 8.6% growth recorded in March.

Same-store sales rose 4.4% over last year, easing from a 6.4% rise in March.

President Donald Trump's aggressive and unpredictable policies have created uncertainty in the U.S. economy, prompting consumers to spend cautiously.

Costco blamed two factors for lower growth.

April had one less shopping day versus last year, due to the calendar shift of Easter, which negatively affected total and same-store sales by about 1.5 to 2 percentage points.

The company said unfavorable foreign exchange rates and lower gasoline prices also affected its topline.

However, investor sentiment toward Costco remains broadly positive compared to other retailers, partly due to its subscription-based wholesale model that encourages strong customer loyalty.

Costco stock is up nearly 10% year to date. Last month, the company raised its quarterly dividend by 12%.

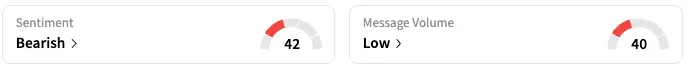

On Stocktwits, the retail sentiment dropped to 'bearish' from 'neutral', and message volume was 'low.'

One bullish user called the April performance "excellent" and said the stock could go over $1,200.

Costco will report its fiscal third-quarter results on May 29.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)