Advertisement|Remove ads.

Costco Or BJ's? Stocktwits Retail Traders Overwhelmingly Favor One Wholesale Giant

Wholesale companies BJ's Wholesale Club Holdings (BJ) and Costco (COST) diverged starkly in their latest quarterly earnings, but retail investors had a marked favorite.

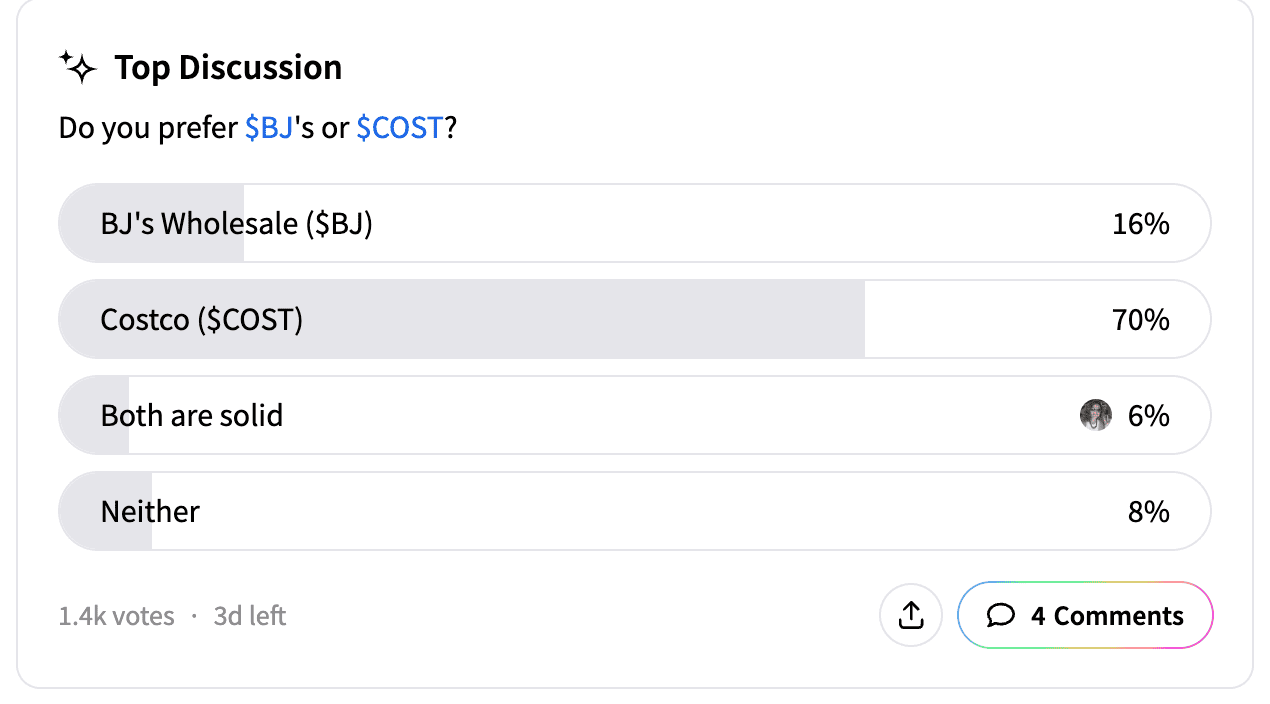

A Stocktwits poll asking which company retail investors preferred among the two revealed that about 70% of over 1,400 respondents chose Costco.

Only 16% said they would prefer BJ's Wholesale, which reported better-than-expected fourth-quarter earnings on Thursday.

About 6% of respondents thought both companies were "solid," but 8% picked neither.

"As a stock, BJ is the right choice. Way less downside risk," said one participant.

Another voter, however, wondered about the hype.

BJ's Wholesale shares climbed more than 12% on Thursday after the company posted its fourth-quarter earnings. Its earnings per share of $0.93 exceeded the expected $0.88, while revenue stood at $5.28 billion, roughly in line with estimates.

BJ's total comparable club sales increased by 4.0% and 2.5% in the fourth quarter and fiscal 2024, respectively, compared to the fourth quarter of the prior year and fiscal 2023.

Shares of Costco, meanwhile, fell 1.20% in after-hours trading on Thursday following the retailer's worse-than-expected fiscal second-quarter earnings despite an increase in same-store sales.

Costco's comparable sales increased 6.8% year-over-year, better than the 6.4% that Wall Street expected. Costco's earnings per share came in at $4.02, missing estimates of $4.09. Revenue came in at $62.53 billion, rising 9.1% year-over-year but below the $63.11 billion estimate by Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)