Advertisement|Remove ads.

Costco Stock Slips Despite Q4 Beat From Membership Hikes, Youth Spending — Cramer Says 'Great Time to Buy,' Retail Agrees

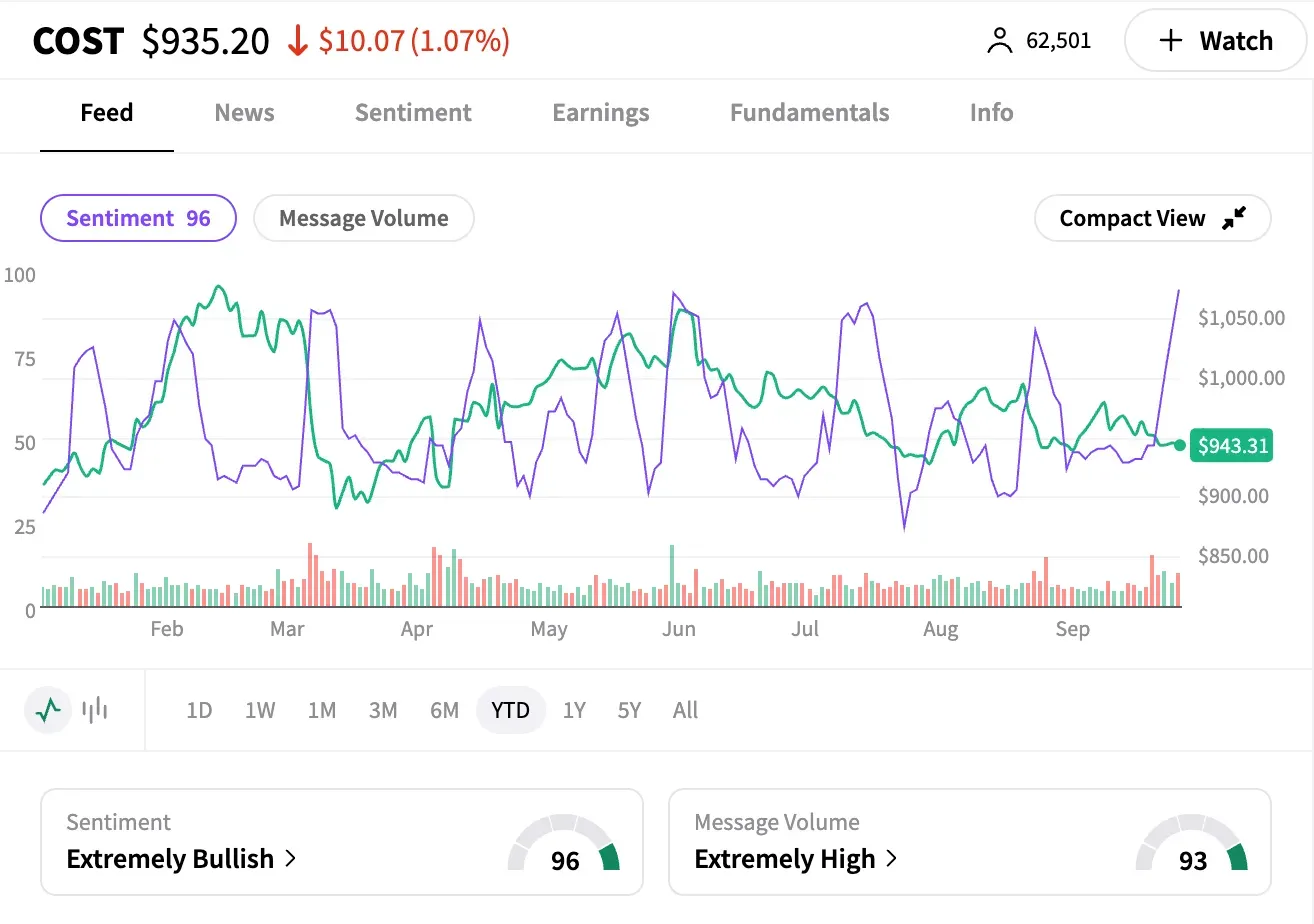

Retail trader confidence in Costco Wholesale Corp surged to its highest level this year on Stocktwits, following the warehouse club chain's strong fourth-quarter report.

The sentiment meter on the platform shifted higher in the 'extremely bullish' zone (96/100) late Thursday, with the 24-hour message surging 840%, as observers dissected the fine print of its latest financial report.

Costco beat estimates for quarterly revenue and profit. Paid members increased by 6% during the quarter, and, along with the higher fee implemented last September, drove an 8% increase in total revenue.

The performance is notable amid a broader consumer slowdown and rising costs from U.S. tariffs. Costco has recently reduced its product selection and is working to source more items locally to mitigate those headwinds.

Costco experienced strong demand for its private-label products, while a higher percentage of younger users joined as members last quarter, according to management comments during the earnings call.

Shares initially jumped in extended trading but lost steam later on, ending the after-hours session down 0.9%.

"I think pushing this thing down will be hard, in fact, very hard," a user said. "Only if you can get people to take a low or very small profit!"

CNBC "Mad Money" host Jim Cramer said on X that Costco's results were "great numbers, but no one cares. What a great time to buy."

Revenue came in at $86.16 billion, compared with the average estimate of $86.06 billion from LSEG/Reuters. Total same-store sales, excluding gas, rose 6.4%, slightly shy of the 6.44% and likely worrying investors.

Adjusted profit was $5.87 per share, compared with expectations of $5.80.

As of last close, COST shares are up 3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_upwork_jpg_f9d5e591d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)