Advertisement|Remove ads.

Coterra Energy Q1 Preview: Oil And Gas Output In Spotlight; Macroeconomic Factors To Drive Chatter

Coterra Energy (CTRA) stock rose about 1% over the past week ahead of the scheduled release of its first-quarter earnings report on Monday.

Wall Street expects the company to report adjusted earnings of $0.79 per share on revenue of $1.88 billion.

Coterra has topped analysts’ expectations in two of the previous four quarters.

The oil and gas producer’s first-quarter profits are expected to decline due to a fall in oil prices.

Average benchmark Brent crude prices remained below year-ago levels in the first quarter, hurt by pressure on demand from the weakening global economic outlook and OPEC+ supply boost.

According to TheFly, Barclays analysts wrote in April that the focus will be on the macro environment this quarter, as companies with low break-evens and strong balance sheets show better protection in a low oil price environment.

Like its shale peer Diamondback Energy, investors would watch Coterra’s forecast keenly.

As per the company’s earlier projections, its 2025 total production is expected to be up approximately 9% year-over-year at the mid-point, with oil volumes up about 47%.

While there have been concerns on the oil side, the outlook for natural gas has been slightly brighter with long-term demand prospects from U.S. liquefied natural gas projects and power producers.

Several countries may opt to boost their purchases of U.S. LNG to lower their trade deficit.

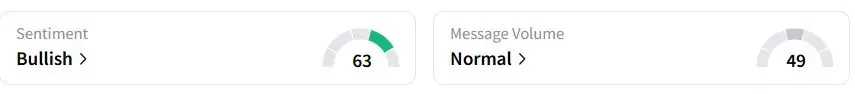

Retail sentiment on Stocktwits was in the ‘bullish’ (63/100) territory, while retail chatter was ‘normal.’

One retail trader was looking forward to hearing the production results on the two-mile horizontal Wolfcamp well Coterra is drilling in New Mexico.

Coterra shares have fallen 1.3% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)