Advertisement|Remove ads.

Coterra Energy Q4 Earnings Preview: Weak Oil Prices To Dent Income, Retail’s Neutral

Coterra Energy (CTRA) stock gained 1.9% over the past week ahead of the oil and gas producer’s fourth-quarter earnings report, which is scheduled for Monday after the bell.

According to Koyfin data, Wall Street expects Coterra to report fourth-quarter earnings per share of $0.43 and revenue of $1.40 billion. The company failed to meet market expectations for quarterly profit in the two previous quarters.

Like its peers, Coterra’s fourth-quarter earnings are expected to take a hit from lower oil prices.

According to TheFly, Roth Mkm analysts said in a research note that there is modest downward pressure on oil prices for the remainder of 2025 due to likely supply increases from the OPEC+ producer group.

The research firm said this is expected to be largely offset by the loss of barrels in sanctioned countries like Iran and Russia.

The company had forecast its 2024 oil production to grow by 12% compared to last year on strong well performance.

U.S. oil production hit a record high in 2024 as technological advancements helped companies to drill longer wells.

In January, Coterra completed asset acquisitions worth nearly $4 billion and gained almost 49,000 acres in the Permian basin.

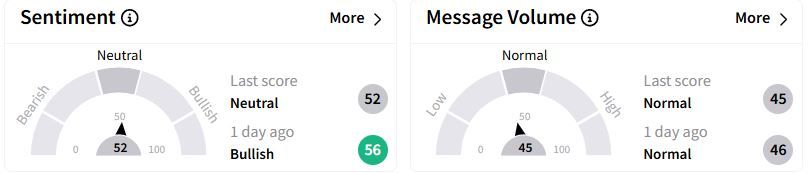

Ahead of the earnings, retail sentiment on Stocktwits moved to ‘neutral’ (52/100) territory from ‘bullish’(56/100) a day ago, while retail chatter was ‘normal.’

Its peers ConocoPhillips, Devon Energy, and Occidental Petroleum topped fourth-quarter profit estimates earlier.

Over the past year, Coterra stock has gained 12.2%.

Also See: H&E Equipment Services Stock In Spotlight After Q4 Earnings Beat, Retail Stays Ecstatic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)