Advertisement|Remove ads.

H&E Equipment Services Stock In Spotlight After Q4 Earnings Beat, Retail Stays Ecstatic

H&E Equipment Services (HEES) stock garnered retail attention on Monday after the company’s fourth-quarter earnings beat Wall Street’s estimates.

On Friday, the company reported adjusted earnings of $36.1 million, or $0.99 per share, for the fourth quarter. According to Koyfin data, analysts, on average, expected the company to post $0.78 per share.

The equipment rental company reported quarterly sales of $384.1 million, compared with Wall Street’s estimated $372.5 million.

The company’s rental revenue rose 0.9% to $283 million compared to the same period last year.

It reported fourth-quarter net income of $32.8 million, or $0.90 per share, compared to $53.5 million, or $1.47 per share, last year.

The company said that average rental rates fell 1.1% from the year-ago quarter and 0.3% sequentially.

At the end of the fourth quarter, the original equipment cost of the company’s rental fleet was about $2.9 billion, a 5.5% rise compared to last year.

H&E Equipment said its rental equipment sales fell 30.1% to $28.4 million, while new equipment sales more than doubled to $20.9 million.

Last week, H&E Equipment Services agreed to be acquired by Herc Holdings for $104.89 per share after outbidding United Rentals.

Herc had said that its proposal represents a 14% premium to United Rentals’ cash-capped consideration.

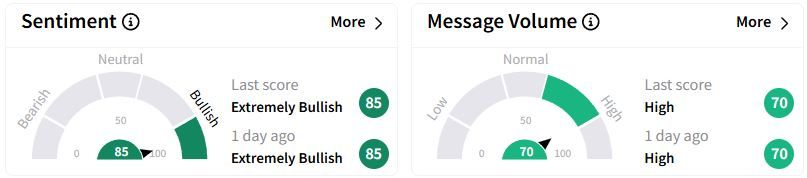

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (85/100) territory while retail chatter was ‘high.’

Over the past week, H&E Equipment shares have gained 11%, while over the past 12 months, the stock has gained 81%.

Also See: ESAB Stock Receives Evercore Upgrade After Recent Selloff, Retail Stays Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUV_Southwest_bags_jpg_0c65f623c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)