Advertisement|Remove ads.

Coty Boardroom Reset Looms As Majority Owner Plans Chair Exit And CEO Change After Prolonged Struggles: Report

- Shares are down over 50% in the past year following repeated earnings disappointments.

- Coty is reviewing its consumer beauty brands and restructuring operations after a sharp mass-market sales decline.

- The company is preparing for the loss of the Gucci beauty licence from 2028 and pursuing new licensing deals.

Coty’s majority owner JAB Holdings is reportedly moving toward a leadership reset at the cosmetics group, with plans that include the exit of chair Peter Harf and a subsequent change at the chief executive level.

The proposal would see a new chair appointed first, followed by the selection of a new chief executive, replacing Sue Nabi after a period of weak operating performance, according to a report by The Financial Times.

Harf has been steadily stepping back from his roles within JAB after retiring earlier this year as managing partner of the Reimann family’s investment firm, leaving Coty as one of his remaining board positions, the report said.

Prolonged Earnings Pressure

Coty has been under sustained financial pressure, with repeated earnings misses eroding investor confidence.

The company’s U.S.-listed shares have lost roughly 53% over the past year, while its market value has fallen to about $2.9 billion, down from around $10 billion two years ago. The company previously linked the weaker results to a slowdown in the broader beauty market, the Financial Times report noted.

Consumer Beauty Review Under Way

In September, Coty said it was reviewing its consumer beauty business, a process that could result in the sale or spin-off of the unit. The review covers brands including CoverGirl, Rimmel, Sally Hansen and Max Factor, as well as its Brazil business.

At the same time, Coty announced organisational changes to more closely integrate its Prestige Beauty and Mass Fragrance units, which together account for about 69% of group sales, after the mass-market beauty segment posted a 12% drop in quarterly sales.

Gucci Licence Setback

Coty faced another setback in October after Kering agreed to sell its beauty business to L’Oreal for about €4 billion ($4.7 billion), a deal that will see L’Oreal take over the Gucci fragrance and beauty licence from 2028. Citi analysts estimate the Gucci beauty line contributes roughly 9% of Coty’s revenue.

Nabi reportedly declined financial proposals from L’Oréal to end the licence early. Kering has previously expressed dissatisfaction with Coty’s handling of the Gucci beauty business.

On a November earnings call, Nabi said Coty would look to offset the loss of the Gucci licence with new licensing deals over the coming years, while acknowledging a hit to profits.

How Did Stocktwits Users React?

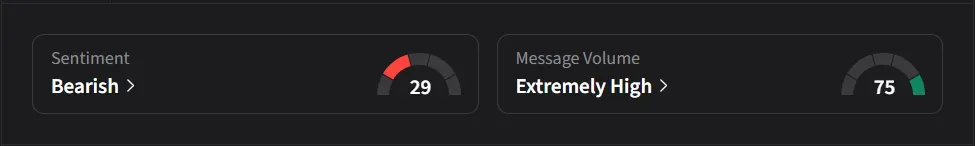

On Stocktwits, retail sentiment for Coty was ‘bearish’ amid ‘extremely high’ message volume.

One user said it looked like Sue Nabi was being fired, adding that Coty’s struggles were striking and that JAB’s tight control has kept large funds on the sidelines.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)