Advertisement|Remove ads.

CRML Stock In Spotlight After Securing $20M Stockpile Of UHP Copper Powder

- CRML will issue two million ordinary shares in exchange for 40 kilograms of the material.

- UHP copper powder is used in semiconductors, printed circuit boards, aerospace 3D printing, coatings, high-density satellite components, and superconducting systems.

- The acquisition comes after the U.S. government added copper to its critical minerals list earlier this month.

Critical Metals Corp. (CRML) stock was in the spotlight on Friday after it secured stockpiles of ultra-high-purity (UHP) copper powder for $20 million.

The company acquired the resource from Swiss Commodity RE in an all-share transaction priced at $10 per share. CRML will issue two million ordinary shares in exchange for 40 kilograms of the material. This represents a 40% premium to Thursday’s closing price.

CRML stock reversed early gains, trading 0.7% lower and is on track to fall for a fifth successive session.

What Is UHP And Why Is It Important?

Ultra-high-purity copper powder, at 99.96% purity, commands a price of $1,500 to $2,500 per gram and is not traded on traditional exchanges. It is used in semiconductors, printed circuit boards, aerospace 3D printing, coatings, high-density satellite components, and superconducting systems.

Historically, supplies of such high-grade copper have been dominated by Russia and China, making this acquisition a significant move for Critical Metals.

“This acquisition immediately expands our Department of War and North American Treaty Organization supply capabilities, deepens customer engagement, and supports the development of our critical metals projects through a new non-dilutive and highly commercial opportunity, that benefits our shareholders,” said Tony Sage, Chairman of CRML.

The acquisition comes as the U.S. intensifies efforts to strengthen domestic production and lessen dependence on Chinese supplies of key minerals. Earlier this month, the government added copper, silver, uranium, and others to its critical minerals list.

The acquisition also complements the company’s broader development of strategic minerals, including the ongoing progress at the Tanbreez rare earth mine in Greenland.

How Did Stocktwits Users React?

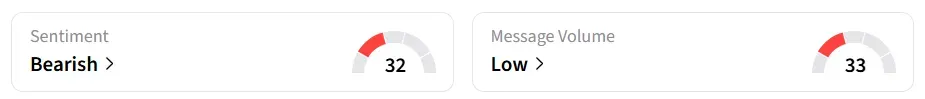

Retail sentiment for CRML on Stocktwits has remained in the ‘bearish’ territory over the past 24 hours.

One user highlighted the strategic benefits of the copper stockpile purchase.

Year-to-date, the stock has climbed around 7%.

Also See: Bitcoin ETFs Hit Record Monthly Outflows In November – Average Investor Now in the Red, Says Analyst

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)