Advertisement|Remove ads.

CSX, Intel, Palantir, Nvidia, Merck: What Sparked Heavy After-Hours Trading In These 5 Stocks?

Tech rout led to another session of weakness on Wall Street on Tuesday as heavily-weighted Nvidia (NVA), peer AMD (AMD), and data analytics company Palantir (PLTR) all serving as drags.

As the market struggles to regain its footing, some stocks saw brisk activity in the extended session on Tuesday.

Corp. (CSX)

After-hours move: -0.22%

Trading volume: 12.41 million

Railroad transportation company CSX gained 1.47% on Tuesday, with the upside accompanied by more than two times the average volume. The rally came amid activist investor and hedge fund Ancora demanding that the company pursue merger talks with Berkshire Hathaway (BRK-A) (BRK-B)-owned BNSF Railway and Canadian peer Canadian Pacific Kansas City (CP).

Ancora’s demands come close on the heels of Norfolk Southern (NSC) and Union Pacific (UNP) announcing a merger deal.

On Stocktwits, retail sentiment toward CSX stock remained unchanged at ‘bearish’ (41/100) by late Tuesday, with the message volume at ‘low’ levels.

CSX stock is up over 14% this year.

Intel Corp. (INTC)

After-hours move: -1.15%

Trading volume: 12.28 million

Intel stock jumped nearly 7%, standing tall among the tech ruins of Tuesday, following the news that the U.S. government could take a stake in the company. Commerce Secretary Howard Lutnick said in a CNBC interview that the government should get an equity stake for “our money,” referring to the funding given under the CHIPS Act.

Lutnick’s comments came after a Bloomberg report stating on Monday that the government was mulling a 10% stake in Intel, thus becoming the company’s largest shareholder. The same day, Intel announced that Masayoshi Son-led investment company SoftBank (SFTBY) agreed to invest $2 billion in the chipmaker.

Intel stock continued to attract ‘extremely bullish’ (89/100) reaction on Stocktwits, and the message volume also stayed ‘extremely high.’

Intel stock has gained 26% so far this year.

Palantir Technologies, Inc. (PLTR)

After-hours move: -2.69%

Trading volume: 7.66 million

Valuation concerns have sent Palantir stock lower for a fifth straight session on Tuesday as investors and analysts deliberate what some seem to think is a “sky-high valuation” relative to the company’s fundamentals.

Short seller Andrew Left disclosed his short position in Palantir in a media interview last week, with his firm Citron Research releasing a full-fledged short report on Palantir on Monday. The firm said Palantir’s valuation should only be at $40, even if valued generously.

Retail mood toward Palantir stock remained ‘bearish’ (32/100), while the message volume perked up to ‘high’ levels.

Palantir stock has gained about 109% this year.

After-hours move: -0.34%

Trading volume: 6.08 million

Nvidia's stock plunged 3.50% on Tuesday as investors turned wary over the continuation of the stock rally and the artificial intelligence (AI) boom. The Bank of America’s Chief Equity Strategist, Savita Subramanian, said the run in mega-cap stocks could end if the Federal Reserve’s next move is a rate cut and the “regime indicator is shifting to a recovery.”

The chipmaker is also under pressure due to the uncertainty around Washington’s China chip curbs. A Reuters report said on Tuesday that the company is readying a Blackwell AI chip for the Chinese market.

The stock also reacted to a disclosure by Nvidia on Monday regarding stock sales by CEO Jensen Huang.

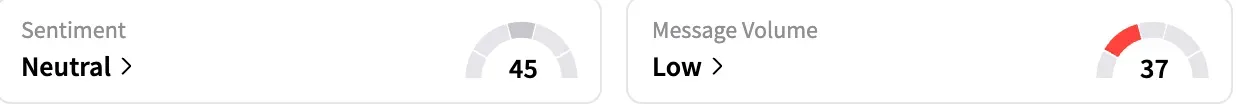

Retail sentiment toward Nvidia stock improved to ‘neutral’ (45/100) by late Tuesday from ‘bearish’ a day ago, while the message volume stayed ‘low.’

NVIDIA's stock has gained nearly 31% year-to-date.

Merck & Co., Inc. (MRK)

After-hours move: unchanged

Trading volume: 4.40 million

Pharma giant Merck was on investors’ radar in the extended session despite the lack of any meaningful news to drive it. The company announced Monday that the FDA granted its antibody drug conjugate (ADC) candidate “Breakthrough Therapy” designation, which is being evaluated as a treatment candidate for lung cancer.

Merck stock elicited a ‘neutral’ reaction (45/100) from retail users of the Stocktwits platform and the retail activity was ‘low.’

So far this year, the stock has lost about 13%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1449195267_jpg_c8a3db2d5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)