Advertisement|Remove ads.

Cummins Stock Gains After Q4 Revenue Impresses Wall Street: Retail’s On Wait-And-Watch Mode

Cummins Inc (CMI) stock gained 4.4% on Tuesday after the company’s fourth-quarter earnings topped Wall Street estimates.

The power solutions provider’s fourth-quarter (Q4) revenue of $8.45 billion beat the average analysts’ estimate of $8.09 billion, according to FinChat data. However, sales declined 1.1% year-over-year due to a 3% fall in international revenue.

It also reported a net income of $418 million, or $3.02 per share, for the three months ended Dec. 31, compared to a net loss of $1.4 billion, or $10.01 per share, in the year-ago quarter.

The company’s fourth-quarter profits were hit by its new power segment Accelera's reorganization actions, which amounted to $312 million, or $2.14 per share, in non-cash charges.

The Columbus, Indiana-based company said its power solutions unit sales jumped 22% to $1.7 billion while distributions segment revenue rose 13% to $3.1 billion.

The company attributed the rise to increased power generation demand, particularly for artificial intelligence data centers.

Its component segment sales slumped 17% to $2.6 billion compared to last year, hurt by the separation of its Atmus unit and lower demand in heavy-duty truck markets.

Engine segment sales also fell 2% to $2.7 billion.

Cummins forecasts full-year 2025 revenue to be in the range of down 2% to up 3%.

“In 2025, we anticipate that demand will be slightly weaker in the North America on-highway

truck markets, particularly in the first half of the year, but offset by strength in other key

Markets,” CEO Jennifer Rumsey said in a statement.

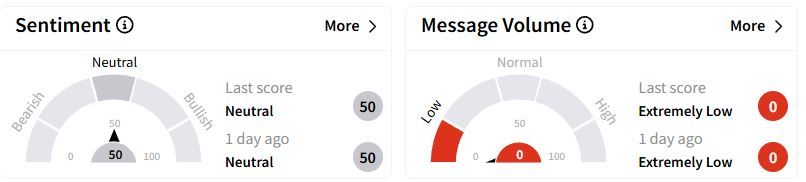

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory.

One Stocktwits user hopes the stock will hit $400 by the end of the following month.

In January, power equipment maker GE Vernova’s shares hit an all-time high after the firm more than doubled its fourth-quarter profit.

Over the past year, Cummins stock has gained 49.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)