Advertisement|Remove ads.

Cyberark Analysts Boost Price Targets For Stock As Cybersecurity Company Delivers Another ‘Picture-Perfect’ Quarter: Retail Lauds ‘Outstanding’ Fundamentals

CyberArk Software Ltd. (CYBR) shares received a solid boost on Thursday after the cybersecurity provider’s better-than-expected fiscal year 2024 fourth-quarter results and analysts’ positive commentary.

Following the print, Wedbush analyst Daniel Ives maintained an ‘Outperform’ rating and upped the price target for the stock to $450 from $325, attributing the price hike to a higher multiple and increased confidence in the company’s ability to execute.

The analyst noted that the report showed beats across the board and the fiscal year 2025 guidance was positive, perking up investor sentiment.

The analyst said, “The ARR machine continues to hum as this was another robust quarter from CyberArk as the company was able to string together another picture-perfect quarter with strong guidance as the company benefits from consolidation tailwinds and execution.”

CyberArk’s fourth-quarter adjusted earnings per share (EPS) edged down to $0.80 from the year ago’s $0.81, exceeding the $0.77 consensus estimate. It also bettered the guidance range of $0.65 to $0.75.

On a reported basis, the company posted a loss of $2.02 per share.

Revenue climbed 41% year over year (YoY) to $314.4 million versus the consensus estimate of $301.3 million and the guidance of $297 million to $303 million. The revenue growth accelerated from the 26% pace in the third quarter.

Subscription revenue climbed 41% YoY to $243 million and maintenance and professional services revenue increased a steeper 62% to $66.4 million.

CyberArk’s total annual recurring revenue (ARR) surpassed $1 billion organically, hitting $1.169 million at the end of Dec. 31, up 51%. This marked an acceleration from the third quarter’s 31% growth.

CyberArk’s CEO Matt Cohen said, “2024 was a milestone year for CyberArk. Our record performance in the fourth quarter and the year reflects the strength of demand for our identity security solutions and the consistent execution of our strategy”

Looking ahead, CyberArk guided to first-quarter adjusted EPS of $0.74 to $0.81 and revenue of $301 million to $307 million. Analysts, on average, estimate $0.77 and $300.9 million, respectively, for the quarter.

The full-year guidance of $3.55 to $3.70 in adjusted EPS and $1.308 billion to $1.318 billion in revenue compares to the consensus estimates of $3.62 and $1.3 billion, respectively.

CyberArk expects to end 2025 with an ARR of $1.41 billion to $1.42 billion, up an estimated 21%.

Separately, the company announced the completion of its acquisition of modern identity governance and administration company Zilla Security for $165 million in cash and a $10 million earn-out tied to the achievement of certain milestones.

It also noted that Builder.ai has chosen it to secure identities across its multi-cloud environment, protecting and automating workforce and developer user access to all apps with intelligent privilege controls.

Ives said he views CyberArk as the premier privileged access management (PAM) player, adding that the company is one of Wedbush’s top cyber names. He noted that the company’s pipeline was up over 100% YoY, indicating strong demand trends in 2025.

Stifel lifted its price target for the stick to $444 from $370 and maintained a ‘Buy’ rating, TheFly reported. The firm said the company remains its top mid-cap idea, given expectations that it has multiple drivers to sustain 20%+ growth along with operating margin and free cash flow expansion potential in the coming years.

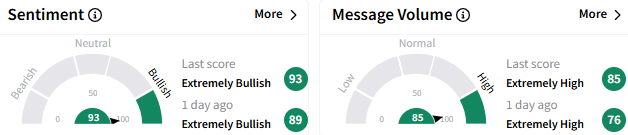

On Stocktwits, sentiment toward CyberArk stock remained ‘extremely bullish’ (93/100), with the buoyant mood accompanied by ‘extremely high’ message volume.

A watcher lauded the company for its “outstanding” fundamentals.

CyberArk stock ended Thursday’s session up 8.78% at $414.31, having gained over 24% for the year-to-date period

For updates and corrections, email newsroom[at]stocktwits[dot]com

Read Next: Apple Stock Leaps Past $240 As Tim Cook Teases New Product Launch, But Retail Sentiment Stays Tepid

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)