Advertisement|Remove ads.

JPMorgan Picks These Two Stocks As Top Bets In India’s Booming Logistics Sector

Shares of Aegis Logistics surged 8% while those of Delhivery climbed 2.1% on Tuesday after global brokerage firm JP Morgan flagged these two stocks as its top picks in a burgeoning Indian logistics sector.

JP Morgan Bullish On Indian Logistics Sector

JPMorgan has initiated coverage on India’s logistics sector, highlighting strong growth potential in the business-to-consumer (B2C) and business-to-business (B2B) express logistics segments, as well as oil and gas logistics, according to reports.

The brokerage firm expects India’s B2C e-commerce logistics market to expand at a compounded annual growth rate (CAGR) of 16% through FY2030, outpacing the broader logistics industry. This growth will be driven by rising e-commerce penetration, faster delivery expectations, and scaling efficiencies across logistics networks.

Top Picks

JPMorgan has picked Delhivery and Aegis Logistics as its top choices in the sector, giving both an ‘Overweight’ rating. The brokerage set a target price of ₹575 for Delhivery, implying a 22% upside from its previous close, and ₹895 for Aegis Logistics, reflecting an 18% premium over its closing price on Monday.

JPMorgan projects Delhivery’s EBITDA to grow at a robust CAGR of 58% between FY25 and FY28, reflecting strong operating leverage and margin expansion.

JPMorgan also initiated coverage on TCI Express and Container Corp, assigning both a ‘Neutral’ rating with price targets of ₹750 and ₹580, respectively. It highlighted competitive pressures from new players, such as Delhivery, for TCI Express, while expressing concerns over Container Corp’s earnings misses and market share losses.

SEBI-registered analysts also shared bullish calls on Delhivery and Aegis Logistics on Stocktwits.

Delhivery: Strong Upside Potential

Delhivery’s stock is showing a robust technical setup, trading around ₹475, just shy of its 52-week high of ₹486. Key support lies at the ₹468 - ₹470 zone, with ₹460 seen as support, said analyst Varun Kumar Patel.

A breakout above the resistance zone of ₹485 - ₹487 could lead to a quick rally toward ₹500 - ₹520, Patel said.

The stock remains in a strong uptrend, comfortably above its 100- and 200-day moving averages, with the relative strength index (RSI) at a healthy 57 and volumes rising on green days, signs of steady accumulation.

Aegis Logistics: Analyst Says Buy

SEBI-registered Wealth Guru recommends taking up fresh positions above ₹820 with targets of ₹835, ₹860, and ₹920, along with a stop-loss at ₹770.

The recommended holding period is 3 - 5 days, they added.

The stock has shown consecutive buying for the past two sessions, even in a sideways market, and recently gave a strong breakout from lower levels, the analyst said.

Stocks Watch

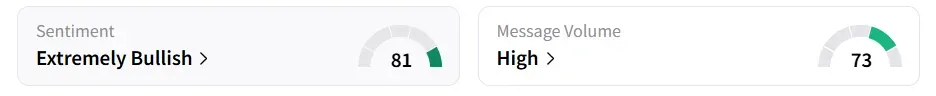

The brokerage report generated ‘extremely high’ buzz for both Delhivery and Aegis Logistics on Stocktwits, with retail sentiment turning ‘extremely bullish’ from ‘neutral’ a day earlier on both the counters.

Year-to-date, Delhivery’s shares gained 36.5% while Aegis Logistics’ stock has declined 2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)