Advertisement|Remove ads.

DELL Pops, HPQ Drops After Quarterly Earnings — Here’s What’s Really Driving The Split

- Dell’s YoY revenue growth of 11% outpaced HPQ’s 4.2% rate, but slowed from 19% in the previous quarter.

- HP envisages job cuts of 4,000 to 6,000 over the following years as it invests in its AI pursuits

- YTD, Dell stock has gained 11%, while HP shares are down 23%.

Shares of legacy personal computing plays Dell Technologies (DELL) and HP, Inc. (HPQ) moved in opposite directions in Tuesday’s extended trading, with earnings being the catalyst. Despite investors’ mixed reaction, retail traders turned markedly upbeat about both companies.

In the after-hours session, Dell stock rose by more than 3%, while HPQ stock fell by more than 5%.

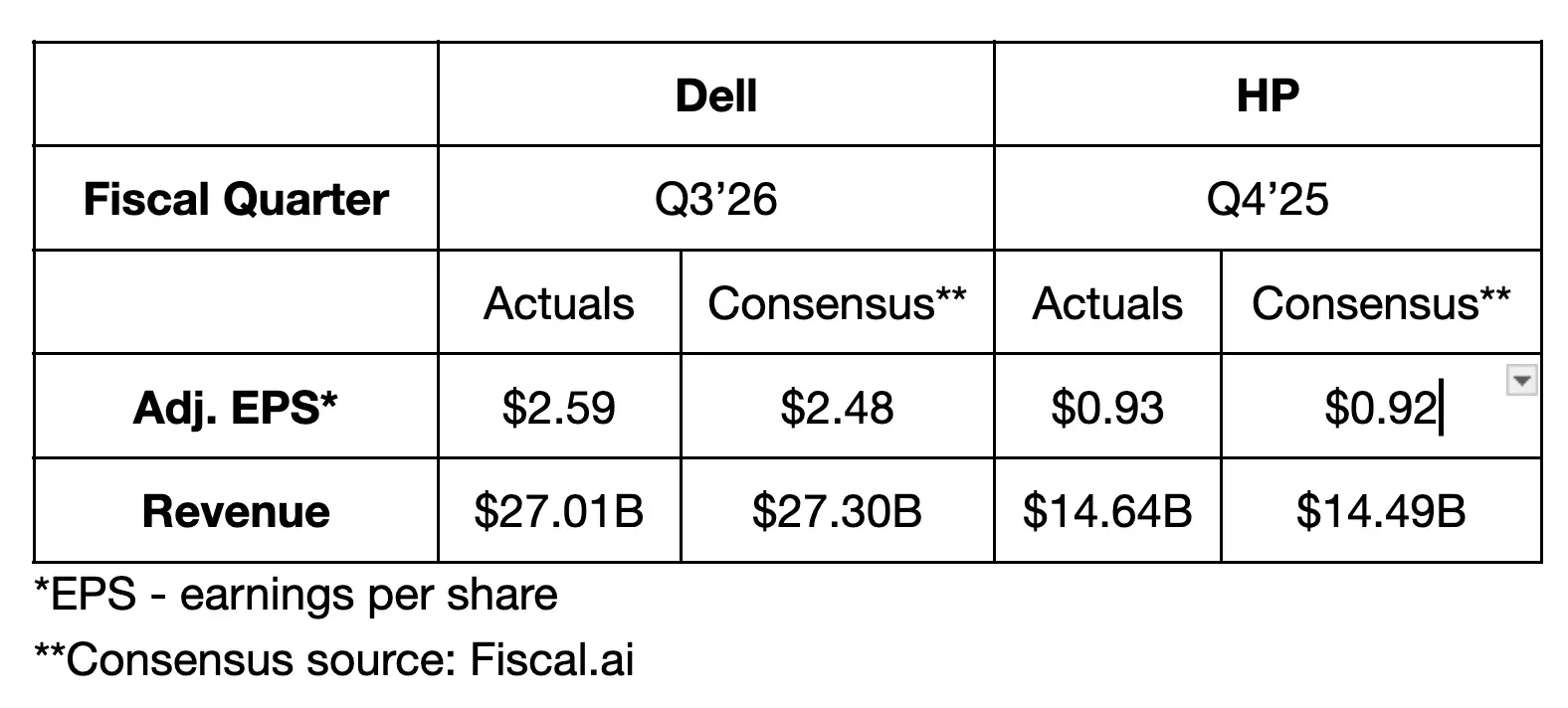

Dell Vs. HP: How Key Quarterly Metrics Compare

Dell’s year-over-year (YoY) revenue growth of 11% outpaced HPQ’s 4.2% rate, but slowed from 19% in the previous quarter. HP’s revenue growth, however, accelerated from 3.1% in the last quarter.

The C-suite of both companies struck a positive note. Round Rock, Texas-based Dell’s CFO, David Kennedy, said Q3 revenue and profitability hit record levels and the company generated strong cash flow as well. HP CEO Enrique Lores said, “HP’s strategy to lead the Future of Work continues to deliver strong performance, marked by our sixth consecutive quarter of revenue growth.”

Did Dell Win With AI Surge?

Dell spoke about accelerating artificial intelligence (AI) momentum in the second half of the year. COO Jeff Clarke said the company’s AI server orders were at a record $12.3 billion. He also said the company had $30 billion in orders year-to-date (YTD).

“Our five-quarter pipeline is multiples of our $18.4 billion backlog with a mix of neocloud, sovereign and enterprise customers,” Clarke said. He attributed the company’s AI outperformance to its “ability to engineer bespoke high-performance solutions, rapidly deploy large, complex clusters, and provide global support.”

HP’s Lores spoke about the company accelerating innovation across AI-powered devices to drive productivity, security and flexibility for its customers.

Dell vs. HP: How Business Segments Fared

Dell’s Infrastructure Solution segment’s revenue (52% of the total) climbed 24%, thanks to record Servers and Networking revenue, which rose 37% to $10.1 billion. But storage revenue slipped 1% to $4 billion.

Dell managed to offset a 7% YoY drop in consumer PC revenue by a 3% increase in commercial client revenue. In all, Dell’s Client Solutions revenue climbed 3% to $12.5 billion. HP, meanwhile, reported an 8% increase in Personal Systems revenue to $10.4 billion, with consumer and commercial PC revenue growing YoY. Printing revenue, which has a better margin, fell 4% to $4.3 billion.

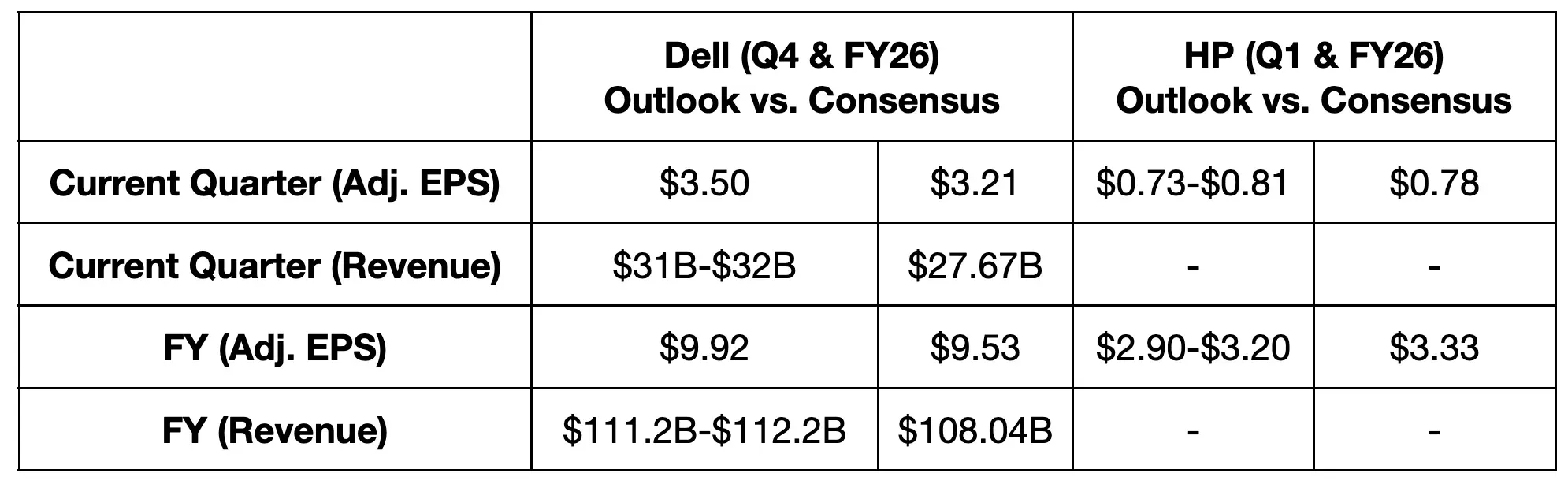

Dell Vs. HP: How Outlook Compares

Dell raised its AI shipment guidance for fiscal year 2026 to about $25 billion, marking 150% YoY growth, and, as an extension, upped its revenue guidance for the year.

HP’s Parkhill sounded out cost cuts. “Looking forward, we are taking decisive actions to mitigate recent cost headwinds and are investing in AI-enabled initiatives to accelerate product innovation, improve customer satisfaction, and boost productivity.”

On the call, the CFO said the company has already made excellent progress, identifying key focus areas expected to generate $1 billion in gross run-rate savings by the end of fiscal year 2028, according to a Koyfin transcript.

CEO Lores quantified the envisaged job cuts at 4,000 to 6,000 over the following years.

The executive also said the company expects industrywide PC shipments to decline in units in 2026, but revenue total addressable market (TAM) to grow in low single digits. For HP, he expects market share gain in premium categories, including AI PCs, workstations, and new devices, but hinted that much of the growth could come in the second half of the year.

Dell vs. HP: How Retail Reacted

On Stocktwits, retail sentiment toward Dell improved to ‘extremely bullish’ as of late Tuesday, from ‘bullish' the day before. Meanwhile, sentiment toward HP stock flipped to ‘bullish’ from ‘bearish.’ The message volume on both streams increased to ‘extremely high’ levels.

Commenting on the Dell stream, a user highlighted the strong AI server shipment forecast and the record pipeline. Another user expected the stock to hit $135 on Wednesday, then rise to $150 in the short term. It ended Tuesday’s session down 1.02% at $125.92.

Dell Vs. HP: Which Stock Is Doing Better This Year?

YTD, Dell stock has gained 11%, while HP shares are down 23%. According to Koyfin, Dell’s average price target on Wall Street implies over 28% upside from current levels, compared with a more modest 14% for HP.

HP, however, trades at a more affordable valuation than Dell, with its forward Price/Earnings (PE) multiple at 7.7 compared to 12.1 for Dell.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)