Advertisement|Remove ads.

Diageo Sees $150M Annualized Hit From Tariffs But Retains Full-Year Outlook: Retail In High Spirits

Diageo (DEO) on Monday said it expects to take a $150 million hit in both this fiscal year and the next due to higher tariffs, but reaffirmed its forecast and outlined a cost-saving plan to help ease the impact.

The British spirits giant, known for Johnnie Walker whisky and Smirnoff vodka, said it would kick off a fresh turnaround program, under which it hopes to deliver $500 million in cost savings over three years.

The company expects to offset some of the impact through those measures before a potential price hike.

"Assuming the current 10% tariff remains on both UK and European imports into the U.S., that Mexican and Canadian spirits imports into the U.S. remain exempt under USMCA, and that there are no other changes to tariffs, the unmitigated impact of these tariffs is estimated to be (around $150 million) on an annualized basis," Diageo said.

U.S.-listed shares of the company fell 0.7% on Monday.

Diageo said net sales increased 3% to $4.38 billion in its fiscal third quarter ended March. Organic net sales rose 5.9%.

The topline improvement came as North American consumers loaded up on alcohol before tariffs kicked in, and the company said the trend will phase out this quarter.

Diageo added that it is on track to deliver a sequential improvement in its organic net sales for the second half of the fiscal year ending June, compared with the first half.

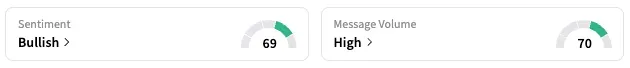

On Stocktwits, the retail sentiment for Diageo jumped to 'bullish' from 'bearish' the previous day.

Diageo stock is down 10% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)