Advertisement|Remove ads.

Diamondback Energy Rises Aftermarket On Q4 Profit Beat, Retail’s Elated

Diamondback Energy (FANG) stock gained in extended trading on Monday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

According to FinChat data, the oil and gas producer posted adjusted Q4 earnings of $3.64 per share, while analysts, on average, expected the company to report $3.38 per share.

The company’s fourth-quarter revenue of $3.71 billion also topped Wall Street’s estimate of $3.55 billion.

Diamondback’s net income rose to $1.07 billion, compared to $960 million, in the year-ago quarter.

The company’s production volumes soared to 883,424 barrels of oil equivalent per day (boe/d), compared with 462,565 boe/d last year.

Diamondback had strengthened its presence in the Permian basin last year by completing a $26 billion deal for privately held Endeavor Energy.

The gains in production were slightly offset by a decline in oil prices. For the fourth quarter, it posted average unhedged realized prices of $69.48 per barrel, compared with $76.42 per barrel last year.

Peers Coterra, Occidental Petroleum, Devon Energy, and ConocoPhillips had all topped quarterly profit estimates, backed by strong production and improved efficiency.

Diamondback’s average costs per barrel of oil equivalent fell to $10.30 from $10.83 per barrel last year, driven by lower costs at the Midland Basin.

The company forecasted 2025 capital expenditures to range between $3.8 billion and $4.2 billion, compared with the $4.1 to $4.4 billion projected last year.

The Midland, Texas-based company forecasted total production to be between 883,000 to 909,000 boe/d this year, also aided by its $4.1 billion deal for certain assets of Double Eagle IV Midco’s subsidiaries.

The company also raised its quarterly dividend by 11% to $1 per share.

“In 2025, we have again chosen capital efficiency and Free Cash Flow generation over volume growth for our capital plan,” CEO Travis Stice said.

During the annual stockholder's meeting, Stice would step down from his position and hand over the reins to Chief Financial Officer Kaes Van't Hof.

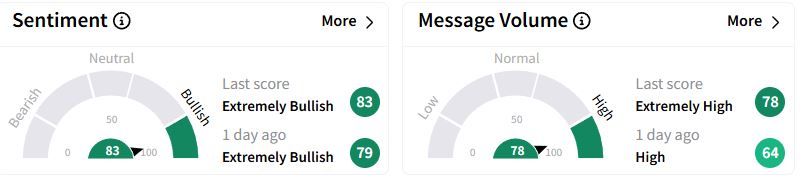

Retail sentiment on Stocktwits moved higher into the ‘extremely bullish’ (83/100) territory than a day ago, while retail chatter rose to ‘extremely high.’

One user said that those who shorted the stock would struggle before giving up their positions.

Another user expected the share prices to rise by $8.

Over the past year, Diamondback stock has fallen 10.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)