Advertisement|Remove ads.

Dick’s Sporting Goods Stock In Focus Ahead of Q4 Earnings As Retail Mood Sours On Market Jitters, Outlook

Shares of Dick’s Sporting Goods Inc. (DKS) were down slightly in after-hours trading on Monday, ahead of its fiscal fourth-quarter earnings, with retail sentiment downbeat about macroeconomic uncertainty.

Gordon Haskett raised the sporting goods retailer’s price target to $280 from $270 with a ‘Buy’ rating as part of the firm's retail outlook for 2025, The Fly reported.

The near-term event path for the sector remains unfavorable, the research firm reportedly said, citing concerns about the outlook for this spring — expected to be coldest in ten years — along with a high degree of tariff and interest rate uncertainty that may hinder Q1 and 2025 guidance below expectations.

For Q4, Wall Street analysts expect Dick’s to post $3.52 in earnings per share on revenue of $3.78 billion. The company beat EPS and revenue estimates in all four of the past four quarters.

One bearish watcher on Stocktwits cited market conditions behind low expectations from the company’s earnings.

Recently, Cleveland Research, however, raised its Q4 comp growth estimate for Dick's to up 4.5% from up 3%, compared to the consensus estimate of 2.6% growth given its holiday sales performance. It also raised its Q4 EPS estimate to $3.83 from $3.66 and its 2025 EPS estimate to $14.88 from $14.81.

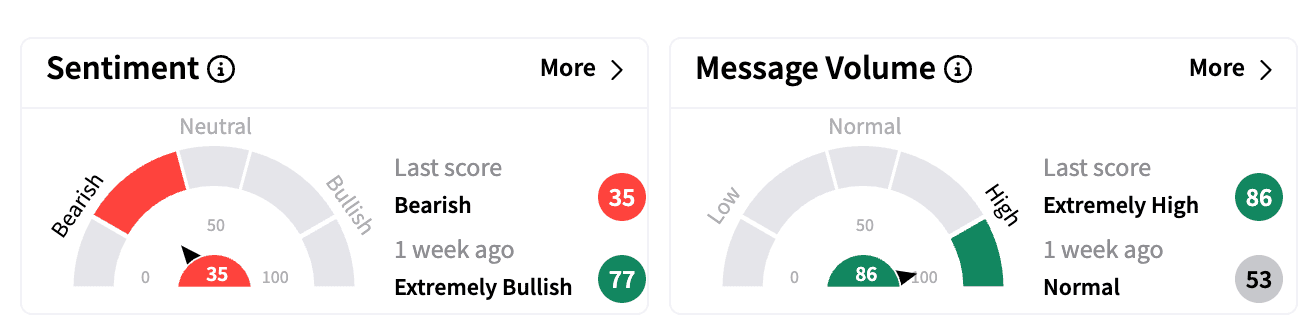

Sentiment on Stocktwits turned ‘bearish’ on Monday compared to ‘extremely bullish’ a week ago. Message volume climbed to ‘extremely high’ from ‘normal.’

Another retail watcher speculated a stock price downslide to under $100.

For the third quarter, Dick’s net sales stood at $3.06 billion, above the estimated $3.03 billion. Its EPS stood at $2.75, beating consensus estimates of $2.68.

The company credited its performance to an “excellent back-to-school season” and “continued focus” on its strategic pillars.

The company also raised its full-year 2024 EPS guidance to between $13.65 and $13.95, up from $13.55 to $13.90 issued previously.

Dick’s Sporting Goods stock is down 7.8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)