Advertisement|Remove ads.

Disney Stock Drops Below $100 As Recession Fears Intensify: Retail Stays Bearish

Walt Disney Co. (DIS) stock plunged below the $100 psychological mark as recession fears intensified after airlines Delta Air Lines, Inc. (DAL), Southwest Airlines Co. (LUV), and American Airlines Group, Inc. (AAL) revised their first-quarter revenue guidance, citing a tempered travel demand outlook.

Disney is also exposed to the vagaries of the economy as its parks and entertainment businesses fall under discretionary spending.

President Donald Trump’s concerted efforts to impose tariffs on North American neighbors Canada and Mexico, as well as China, and as a reciprocal measure against countries with unfair trade terms with the U.S. have dented sentiment of consumers and businesses alike.

Investors fear that if the U.S. actions are met with retaliatory measures, a global recession could be in the works, and inflation will likely rise.

In a note released Friday, Morgan Stanley Chief U.S. Economist Michael Gapen revised his 2025 and 2026 growth estimates for the country to 1.5% and 1.2%, respectively, from 1.9% and 1.3%. The analyst attributed the tempered opinion to the greater-than-expected intensity in trade policies.

The economist also forecasts higher inflation for 2025, with a more pronounced and sooner reacceleration in goods prices. “The mix of firm inflation and low unemployment could put the Fed in a bind,” he added.

Recent consumer sentiment readings have been worrisome. The Conference Board’s consumer confidence index for February slid seven points to 98.3, while the expectations index fell 9.3 points to 72.9.

The Conference Board noted that for the first time since June 2024, the expectations index dropped below 80, which typically signals a recession ahead.

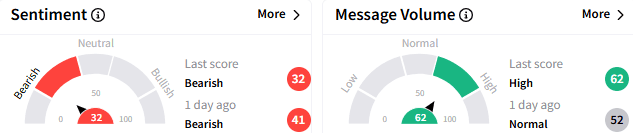

On Stocktwits, retail sentiment toward Disney stock stayed ‘bearish’ (32/100), although the message volume reached ‘high’ levels.

A bearish watcher said that no one will visit the company’s theme parks during a recession.

Another user called Disney the worst-managed company, arguing that it is unable to capitalize on its vast intellectual property (IP).

Disney stock traded down over 5% at $97.64 by Tuesday afternoon, dropping below the $100 mark for the first time since Nov. 12. The stock has fallen 7.4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: ServiceNow Stock Rebounds After Analysts Give Thumbs Up To $2.85B Moveworks Deal: Retail’s Excited

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)