Advertisement|Remove ads.

Dixon Technologies In ‘Golden Buy Zone’, Short-Term Upside Likely Despite Recent Headwinds: SEBI RA Priyank Sharma

Dixon Technologies (India) has been in the limelight after Motorola, its largest client, ended its exclusive partnership with the company and outsourced its domestic production to Karbonn. Reports indicate that Longcheer Mobile India could follow suit.

This led brokerage firm Phillip Capital to slash its price target to ₹9,085, a 38% downside to the current trading price of ₹14,684. The firm maintained a ‘Sell’ rating, citing increased competition in the electronics manufacturing sector.

Earlier this week, promoter Sunil Vachani sold a 2.77% stake in the open market for around ₹2,200 crore. According to reports, Motilal Oswal Mutual Fund bought most of the stake sold by Vachani. The fund reportedly bought 14.46 lakh shares at an average price of ₹13,307 per share.

However, according to SEBI-registered analyst Priyank Sharma, technical charts indicate a bullish view for Dixon’s shares.

After forming a bottom near ₹12,000 during the April 2025 correction, following a brief fake-out below the March low, the price reversed its structure to the upside, rallying to ₹17,000, he noted.

A fake-out is a temporary price move beyond a support or resistance level that sees a quick reversal.

Since then, the stock has retraced nearly 70% to enter the “Golden Buy Zone”, where a strong reaction has been observed, the analyst said.

This suggests a potential move back toward the ₹17,000 level in the near term, with the bullish outlook remaining valid as long as the price stays above ₹14,000, Sharma added.

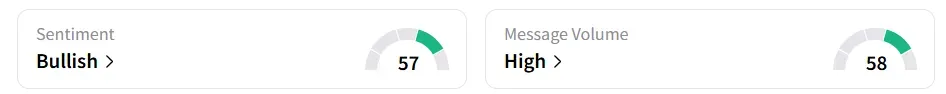

Retail sentiment turned ‘bullish’ from ‘neutral’ a day earlier, amid ‘high’ message volumes. The stock was trending on the platform.

The stock has shed more than 18% year-to-date (YTD), but has been up 5.1% over the past week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)