Advertisement|Remove ads.

DJT Shares Draw Heavy Retail Chatter Amid US Government Shutdown Concerns – Stock Tops Stocktwits Trending List

Trump Media and Technology (DJT) was the second-highest trending ticker on Stocktwits in pre-market trade on Wednesday, as retail traders discussed the U.S. government shutdown and its potential impact.

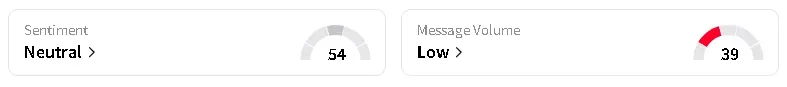

DJT’s stock, widely regarded as a gauge of market enthusiasm around President Donald Trump, traded flat ahead of the market open. On Stocktwits, retail sentiment around the company remained in ‘neutral’ territory over the past day. Platform data showed that chatter increased by 48% in the last 24 hours and by more than 200% over the past month.

Some of the conversation centered on Trump’s recent comments on trade and the military, as well as speculation about his proposed “TrumpRX” initiative and its potential impact on the pharmaceutical industry. Others pointed to the broader political backdrop, debating how long a shutdown could last. The longest U.S. government shutdown on record lasted 35 days, a point frequently cited in discussion threads.

Several traders also focused on the labor impact, with one noting that roughly 750,000 federal workers could face furloughs and potential job losses if the standoff continues. “Cutting government spending is essential,” wrote one user, reflecting polarized views that mixed political support with market speculation.

Trump Media and Technology Group’s (DJT) core business centers on its social media platform, Truth Social. The company has laid out broader expansion plans, including a subscription-based streaming service, Truth+, and a move into fintech and financial services through Truth.Fi. More recently, it launched a Bitcoin (BTC) treasury strategy, amassing roughly $2 billion in Bitcoin and related securities by July 2025.

Despite this positioning, DJT’s shares showed little movement in pre-market trade, even as other digital asset treasury companies such as Strategy (MSTR) and Marathon Digital (MARA) advanced on Bitcoin’s price crossing $116,000.

Read also: BTC, ETH, XRP Rally Fuels Gains In Strategy, Bitmine, And Crypto-Linked Stocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)