Advertisement|Remove ads.

DoorDash Gets A Boost From Benchmark, Retail Investors Improve Their Expectations

DoorDash shares were in the spotlight on Thursday after brokerage Benchmark raised its price target on the stock by $35 to $260 and stated that it expects the second-quarter gross order value and core profit to come in at the high end of the company’s expectations.

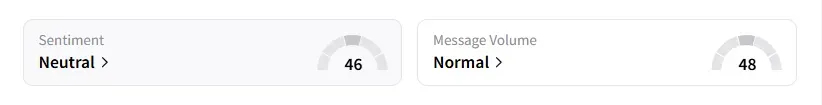

DoorDash shares were up marginally in early trading. Retail sentiment on the stock improved to ‘neutral’ from ‘bearish’ a day ago, with message volume at ‘normal’ levels, according to Stocktwits data.

Benchmark also maintained its ‘Buy’ rating on DoorDash, according to TheFly. The company reports earnings on August 6.

Wall Street expects DoorDash to post second-quarter revenue of $3.16 billion and profit per share of $1.07, according to data compiled by FinChat.

Earlier this week, Jefferies downgraded DoorDash to ‘Hold’ from ‘Buy’ as the brokerage believes that the strength of solid execution and good core profit may already be reflected in the current valuation.

DoorDash has been expanding into groceries and retail to compete with Instacart (CART), which has deep partnerships in grocery and has partnered with Uber Eats, where Instacart customers can use the platform to order from Uber Eats restaurant partners across the U.S.

Despite economic headwinds and consumers becoming increasingly cost-conscious, the industry has experienced strong growth, primarily driven by subscription models, enhanced user experiences, and data-driven personalization.

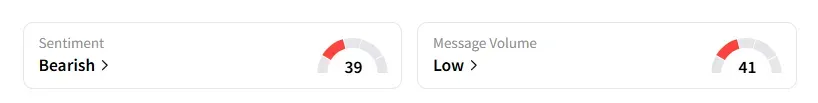

Instacart’s, formally known as Maplebear, shares were up nearly 2%. Retail chatter on the stock remained in the ‘bearish’ territory compared to a day ago, with ‘low’ levels of retail chatter, according to Stocktwits data.

DoorDash stock has risen over 40% year-to-date, while Instacart shares have jumped nearly 18% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: PepsiCo Strips Artificial Colors From Lay’s, Tostitos, But Retail Investors Remain Wary

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)