Advertisement|Remove ads.

DoorDash Retail Sentiment Drops After Successive Price Target Cuts

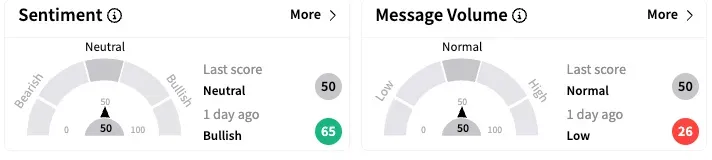

DoorDash, Inc (DASH) received two successive price target cuts from analysts, denting sentiment among retail traders on Stocktwits.

Wedbush reduced the price target to $190 from $210, while KeyBanc lowered it by $10 to $240, according to The Fly.

They maintained their respective 'Neutral' and 'Overweight' ratings on the stock.

Currently, 30 of 45 analysts rate the stock a 'Buy' or higher, according to Koyfin data. Their average price target is $217.91, which signals a 20% upside to DoorDash's last closing price.

Shares of the company closed nearly flat at $181.55 on Tuesday. Although retail sentiment on Stocktwits dropped to 'Neutral' from 'Bullish.

Wedbush, which has broadly reduced 2025 estimates and price targets in its coverage universe, said its latest price action is based on pressure from new tariffs and weak demand in the U.S. and globally.

KeyBanc said its recent mobility and delivery sector analysis showed stable ride-sharing adoption, albeit with some cautionary flags around consumer price sensitivity and autonomous vehicles gaining traction.

One bearish Stocktwits user said the stock faces selling pressure at the current level.

DoorDash shares are down 8.2% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_spy_jpg_a85fe2a8bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246877055_jpg_1283ae3088.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)