Advertisement|Remove ads.

Dow Drops 650 Points, S&P 500 Falls 1.5% As Big Tech Drags US Equities Down

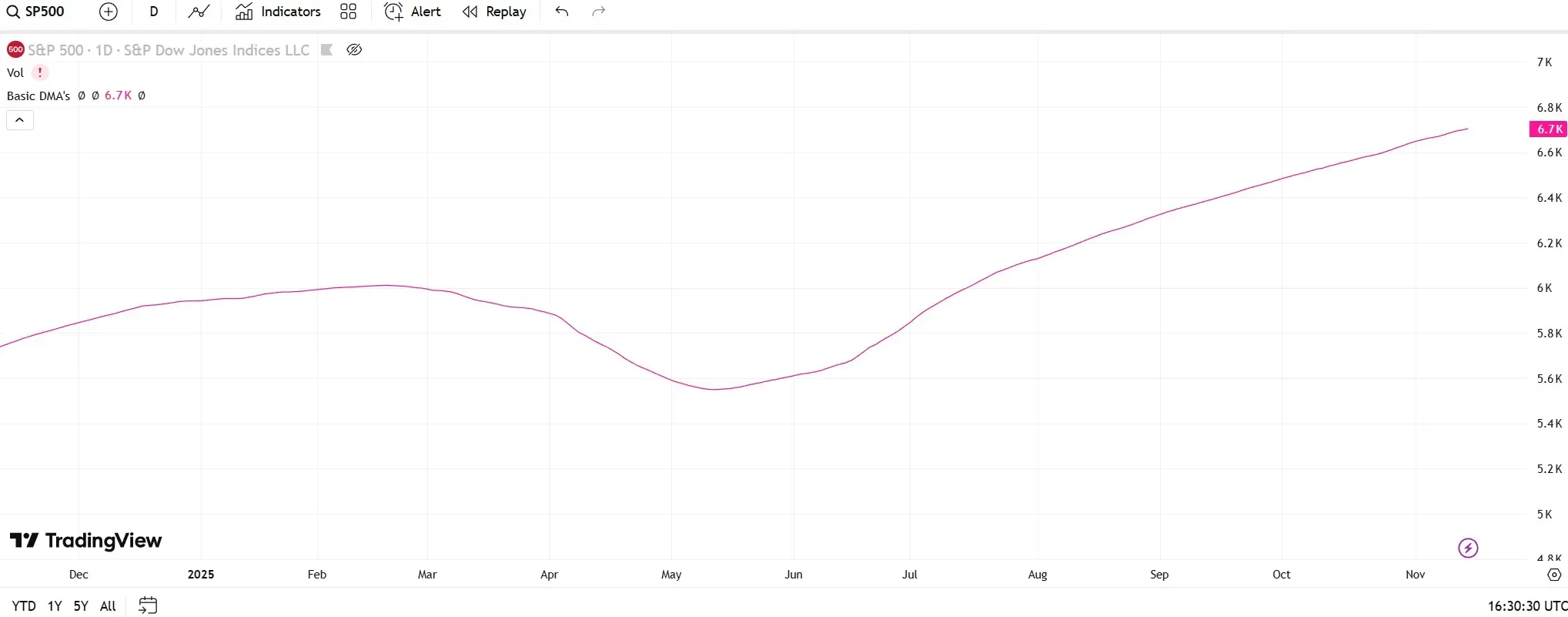

- The S&P 500 index closed below its 50-day moving average on Monday for the first time since April 30.

- The CNN Fear and Greed Index was hovering in the ‘Extreme Fear’ zone at 11, the same level it reached in April.

- Bank of America’s monthly survey for November showed that the average cash held by global fund managers fell to 3.7%, triggering the firm’s “sell signal.”

U.S. equities declined in Tuesday morning’s trade, with Big Tech hovering in the red amid concerns about valuations of AI-related stocks. The Dow Jones Industrial Average was down more than 650 points at the time of writing, while the S&P 500 index was down 1.5%.

All but one of the Magnificent 7 stocks were down at the time of writing, with Microsoft Corp. (MSFT) and Amazon.com Inc. (AMZN) slipping the most at over 3% each, while AI bellwether Nvidia Corp.’s (NVDA) shares were down more than 2%.

Apple Inc. (AAPL) was the lone Mag 7 stock trading in the green, edging up by 0.09% in Tuesday morning’s trade.

S&P 500 Below 50-DMA

The S&P 500 index closed below its 50-day moving average (DMA) on Monday for the first time since April 30. At the time of writing, the S&P 500 index was trading at 6,572, below its 50-dma of 6,717, on track for its fourth consecutive session in the red.

“Typically it would take a few days below that mark, now near 6,707, to signal a major change in what's been an upward trend,” said analysts at Schwab in a recent note.

The CNN Fear and Greed Index was hovering in the ‘Extreme Fear’ zone at 11. The last time it was at this level was on April 16, 2025.

BofA’s ‘Sell Signal’ Triggered

Bank of America’s monthly survey for November showed that the average cash held by global fund managers fell to 3.7%, triggering the firm’s “sell signal”, according to a report by Bloomberg. The survey notes that this has only happened 20 times since 2002.

Investors are now eyeing AI bellwether Nvidia’s third-quarter (Q3) earnings due Wednesday, as well as the minutes of the Federal Open Market Committee’s (FOMC) October meeting.

At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down 0.29%; the Invesco QQQ Trust ETF (QQQ) declined 0.53%; and the SPDR Dow Jones Industrial Average ETF Trust (DIA) fell 0.68%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘neutral’ territory.

Also See: ChatGPT Recovers After Hours-Long Issue Impacting OpenAI’s Service

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)