Advertisement|Remove ads.

Duolingo Rises Premarket After JMP Upgrades Stock Citing Attractive Valuation: Retail’s Mixed

Duolingo, Inc. (DUOL) shares rallied in Tuesday’s premarket after JMP Securities issued a bullish recommendation, but retail is divided.

Pittsburgh, Pennsylvania-based Duolingo is a mobile learning platform.

Duolingo stock pulled back below the $300 level despite reporting strong earnings and revenue growth for the fourth quarter of fiscal year 2024 in late February.

The company’s operational metrics also witnessed substantial growth but the sore spot was the gross margin contraction due to generative artificial intelligence (GenAI) costs from the Duolingo Max adoption.

Duolingo Max is a subscription tier above Super Duolingo that provides three AI-powered features, namely “Explain My Answer, Roleplay and Video Call with Lily.”

Fourth-quarter advertising revenue per daily active users also fell.

JMP Securities on Tuesday upgraded Duolingo stock to ‘Outperform’ from ‘Market Perform,’ with a $400 price target, TheFly reported. The price target implies an upside potential of nearly 36%.

Analysts at the firm noted that the stock valuation suffered after the fourth-quarter report amid the market volatility. They expect Max to drive pricing gains in 2025.

JMP said there is material upside to consensus estimates, rendering Duolingo’s valuation attractive.

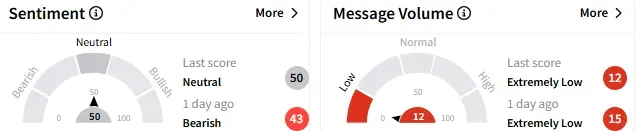

On Stocktwits, retail sentiment toward Duolingo stock improved but remained ‘neutral’ (50/100) compared to the ‘bearish’ mood that prevailed a day ago. The message volume stayed ‘extremely low.’

A bullish user said the stock is on track to reclaim the $300 level.

On the other hand, a bearish user said Duolingo’s offerings are redundant in an era of AI bots.

Duolingo stock is down about 10% this year. The stock has traded in a range of $145.05-$441.77.

The Koyfin-compiled average analysts' price target for the stock is $383.58, implying upside potential of over 30% from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Palantir Retailers Think Correction May Be Over As Stock Picks Up Steam After AIPCon

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)