Advertisement|Remove ads.

DXP Enterprises Stock Rises After Q4 Profit Beat, Retail Mood Brightens

DXP Enterprises (DXPE) stock rose 4.5% in extended trading on Thursday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The company reported adjusted earnings of $1.38 per share, while analysts, on average, expected the company to post $0.89 per share in earnings, according to FinChat data.

DXP’s fourth-quarter sales of $470.9 million, exceeded Wall Street’s estimated $447 million.

The Houston-based company reported a net income of $21.3 million, or $1.29 per share for the quarter ended Dec. 31, compared with $16 million, or $0.94 per share, a year earlier.

The company’s adjusted earnings before interest, taxes, depreciation, amortization, and other non-cash charges (EBITDA) were $50.3 million, compared to $41.9 million in the year-ago quarter.

“We see positive dynamics in our traditional end markets like oil & gas, as well as positive outlooks for end markets like water & wastewater,” CEO David Little said.

The company’s service center segment revenue grew to $310.8 million from $285.4 million in the year-ago quarter.

DXP’s innovative pumping solutions segment sales rose to $97.6 million during the fourth quarter from $60.3 million in the same period last year.

The firm’s sales per business day rose to $7,595 from $6,673 a year earlier.

DXP boosted its offering during the quarter by acquiring a company focused on servicing the municipal water and wastewater treatment markets and another one focused on vacuum pump sales, repair, and maintenance.

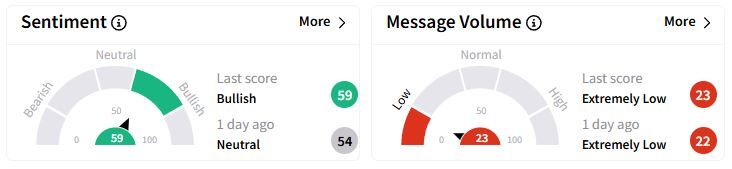

Retail sentiment on Stocktwits rose to ‘bullish’(59/100) territory from ‘neutral’(54/100) a day ago, while retail chatter remained ‘extremely low.’

One user expressed satisfaction with the double beat.

Over the past year, DXP stock has more than doubled.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)