Advertisement|Remove ads.

Venture Global Stock Slumps After Q4 Revenue Miss, $18B Expansion Plan For Louisiana Project: Retail Sees Overreaction

Venture Global (VG) stock plummeted 36% on Thursday after the company posted fourth-quarter revenue below Wall Street’s estimates and unveiled an $18 billion expansion plan for the Plaquemines liquefied natural gas facility.

According to FinChat data, the company posted fourth-quarter revenue of $1.52 billion, while analysts, on average, expected it to post $1.92 billion.

The company’s consolidated adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) fell 15% to $688 million during the quarter, due to lower LNG sales volumes and higher costs to remediate and commission the Calcasieu Project.

In February, the company said it would begin commercial operations at its Calcasieu Pass liquefied natural gas facility on April 15. The LNG project in Cameron Parish, Louisiana, has been in the commissioning phase over the past three years due to the unreliability of its power generators.

The energy firm’s quarterly LNG sales volumes fell 13% to 128 trillion British thermal units.

Venture Global projected 2025 adjusted EBITDA in the range of $6.8 billion and $7.4 billion. Wall Street expects it to post $8.75 billion in adjusted core profit, this year.

The company also launched the final investment decision (FID) process regarding the Calcasieu Pass 2 expansion.

The Arlington, Virginia-based company plans to invest an additional $18 billion at the Plaquemines LNG facility south of New Orleans, Louisiana, and boost the capacity to 45 million metric tonnes per annum (mtpa) from 27 mtpa.

“Our planned expansion of Plaquemines will make it the largest LNG export facility built in North America, supplying LNG to our allies while making a substantial impact on the U.S. balance of trade,” said Venture Global CEO Mike Sabel.

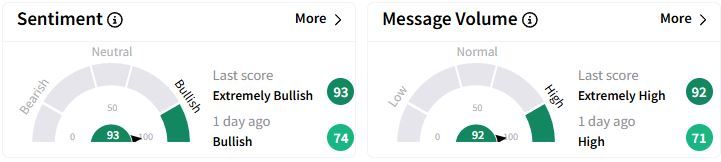

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (93/100) territory from ‘bullish’(74/100) a day ago, while retail chatter rose to ‘extremely high.’

Some traders believed that the selloff was an overreaction.

Since its listing, Venture Global stock has slumped 63.6%.

In January, Venture Global raised $1.75 billion in its initial public offering and briefly became the most valuable U.S. LNG firm.

Also See: Canadian Natural Resources Keeps Retail Traders Bullish With Dividend Hike Even As Q4 Profit Shrinks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)