Advertisement|Remove ads.

Edison International Stock Gains Despite Report Suggesting SCE’s ‘Zombie’ Line May Have Sparked Eaton Fire – Retail’s Still Bearish

Edison International (EIX) shares gained more than 2% on Monday morning despite The Wall Street Journal suggesting that one of Southern California Edison’s (SCE) older power lines, presumed unenergized, may have been the source of the Eaton fire in Los Angeles.

Southern California Edison is a subsidiary of Edison International. It faces enormous liability costs if its equipment is responsible for the recent wildfires, according to the report.

The second-most destructive fire in California history destroyed about 14,000 acres and more than 6,000 homes.

The report said that SCE is looking into an “zombie” or idle power line near the Altadena neighborhood, which isn’t supposed to be connected to the primary grid. Internal investigators are reportedly trying to determine if the power line might have energized through a current created by electromagnetic force or induction.

This is the same power line accused of starting the fires in a video published by a law firm suing Southern California Edison for the Eaton fire.

CEO Pedro Pizarro told The WSJ that idle lines always experience some induction. In order to counteract this risk, he said the SCE had used grounding equipment. This means that even if there is a spark, it gets transmitted directly into the ground.

However, the uncertainty stems from the fact that the company recently discovered damage to the grounding equipment on the line in question. The investigation is looking to determine how and when that happened.

At the time of the fires, CEO Pedro Pizarro admitted in an interview with Good Morning America that the company could not "rule out" the possibility that its infrastructure played a role in the fires.

If found responsible, SCE could dip into the state’s $21 billion fund established to help utilities manage liability costs tied to destructive fires.

In another interview with Bloomberg TV, Pizarro said that the fund will cap the company's exposure at $3.9 billion.

However, to do so without being subject to reimbursements, the company will have to prove to state regulators that its maintenance of the idle line in question was reasonable, or at least in line with common industry standards.

Moreover, if SCE leans heavily on the fund, less money will be available for the other utilities if their lines start other fires.

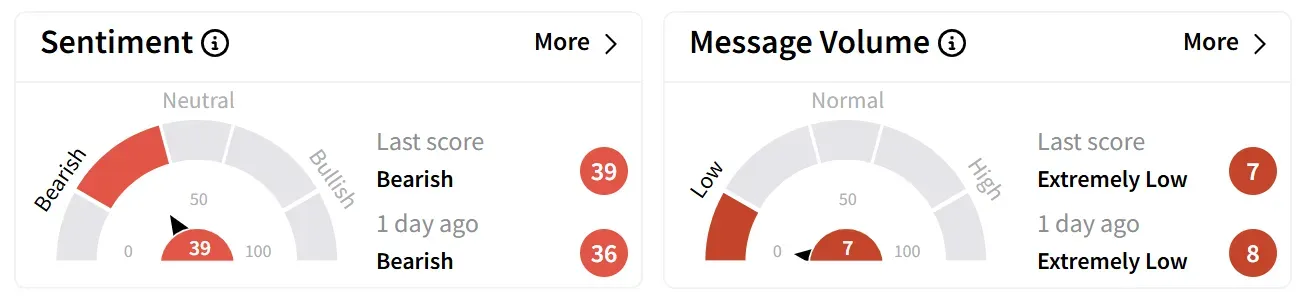

On Stocktwits, retail sentiment around Edison International’s stock ticked high but remained in ‘bearish’ zone with tepid levels of chatter.

Edison’s shares have been down over 17% over the past year, but it saw a sharper dip of nearly 30% this year. Most of the losses took place during the same period as the Los Angeles wildfires, at the beginning of January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)