Advertisement|Remove ads.

Gold Tops $3,000, Boosts Newmont and Other Mining Stocks On Safe-Haven Demand Amid Trump’s Tariff War

Gold mining stocks rallied Friday morning as the precious metal's price soared past the $3,000 mark, driven by renewed trade war fears and increased safe-haven demand.

Gold briefly touched an intraday high of $3,004.78 before paring gains to trade at $2,988.

The SPDR Gold Trust (GLD), which tracks spot gold prices, gained 0.8%, hitting an all-time high of $276.30.

The rally lifted shares of major gold miners. Newmont Corp. (NEM) rose 2.1%, B2Gold Corp. (BTG) gained 3.7%, Kinross Gold (KGC) added 2%, Franco-Nevada Corp. (FNV) climbed 1.4%, and Barrick Gold Corp. (GOLD) advanced 1.6%.

Gold’s surge has been fueled by a combination of economic and geopolitical concerns. The Trump administration has reignited fears of a global trade war by imposing tariffs and threatening new ones on major economies, raising investor anxiety over economic stability.

Meanwhile, signs of economic strain are emerging. The Atlanta Federal Reserve’s GDPNow model projects a 2.4% contraction in the U.S. economy for the first quarter of 2025, while JPMorgan has raised its recession probability for the year to 40%.

Gold, traditionally viewed as a hedge against market volatility, has climbed nearly 14% this year, bolstered by concerns over Trump's trade policies and broader stock market uncertainty.

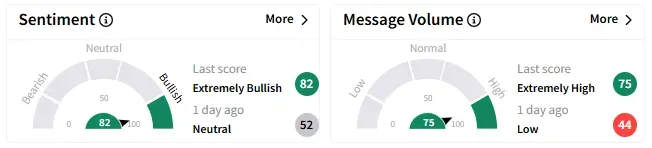

On Stocktwits, retail sentiment around SPDR’s Gold Shares ETF surged to ‘extremely bullish’ from ‘neutral,’ with chatter jumping to ‘extremely high’ levels.

One user remarked that gold ETFs are a must-buy for anyone skeptical of the market’s stability.

Other traders cheered for a sharper rally.

The ETF has gained over 37% in the past year and is up nearly 13% year-to-date.

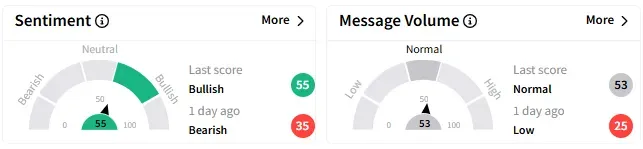

Retail sentiment around Newmont’s stock flipped to ‘bullish’ from ‘bearish’ a day ago, accompanied by rising levels of chatter.

One trader noted that Newmont’s stock is now trading above its 200-day simple moving average (SMA) but needs further confirmation to solidify an uptrend.

Another pointed out that gold mining stocks remain undervalued based on low price-to-earnings ratios, recovering from what was once a “miners are dead” sentiment.

Newmont’s stock has climbed over 22% in 2025 and more than 37% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)