Advertisement|Remove ads.

El-Erian Questions Whether The Fed Should Stick To Its 2% Inflation Target

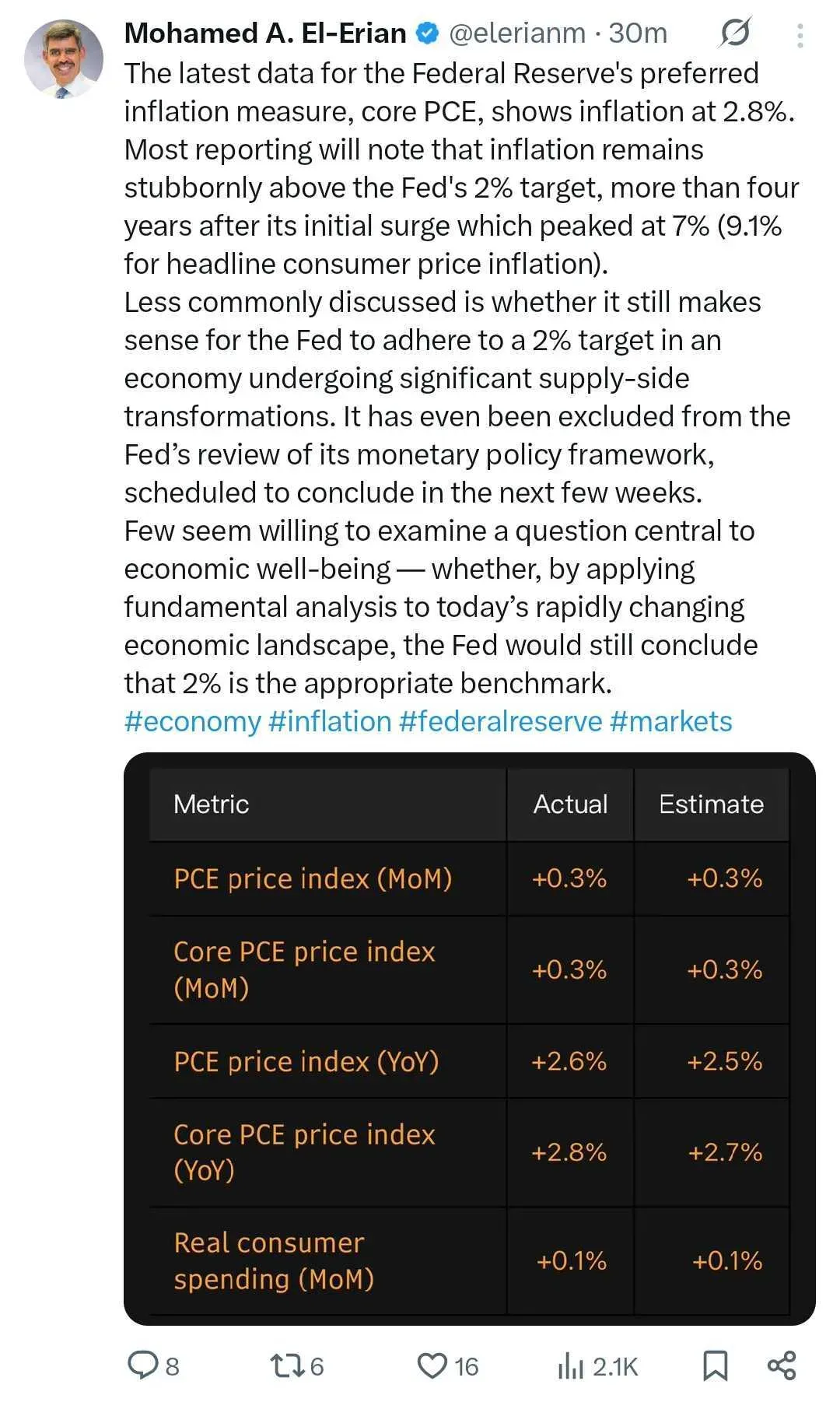

Noted economist Mohamed El-Erian on Thursday questioned whether the Federal Reserve should continue anchoring policy to a 2% inflation target in a structurally shifting economy.

He said that the Fed’s ongoing monetary policy framework review, which is set to close in the coming weeks, does not revisit the target despite core personal consumption expenditures (PCE) coming in at 2.8%.

“Less commonly discussed is whether it still makes sense for the Fed to adhere to a 2% target in an economy undergoing significant supply-side transformations,“ he wrote in a post on X, citing that inflation remains above the 2% threshold even four years after it initially surged to 7%.

“Few seem willing to examine a question central to economic well-being — whether, by applying fundamental analysis to today’s rapidly changing economic landscape, the Fed would still conclude that 2% is the appropriate benchmark,” he added.

The PCE Index, which is the Federal Reserve’s preferred gauge of inflation, rose 2.6% in June, according to data from the Bureau of Economic Analysis (BEA) released earlier on Thursday. On Wednesday, the Federal Reserve kept the key interest rate unchanged in the 4.25% to 4.5% range.

El-Erian isn’t the only economist to question the Fed’s 2% target for inflation. A couple of years ago, former U.S. Treasury Secretary Lawrence H. Summers also advocated rethinking the 2% target, participating in public debates about whether the Fed should stick with or change its inflation framework.

U.S. equity markets were trending higher on Thursday morning. The SPDR S&P 500 ETF (SPY) jumped 0.7%, while the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.13%. On Stocktwits, retail sentiment around SPY, which tracks the broader S&P 500 Index, dipped lower within ‘extremely bullish territory’ over the past day.

Read also: Bitcoin, Ethereum Rebound After Fed Rate Hold – XRP, DOGE, ADA Lead Altcoin Gains

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)