Advertisement|Remove ads.

HP Stock Slips As Weak PC, Printing Sales Weigh On Q1: Retail Stays Cautious As Trump Tariffs Cloud Outlook

HP Inc. (HPQ) shares declined in Thursday’s after-hours trading after the company’s fiscal Q1 2025 earnings came in roughly in line with or slightly below expectations. While HP maintained its full-year guidance, investors reacted to a lackluster Q2 profit outlook that suggested near-term challenges.

The Palo Alto, California-based company’s adjusted earnings per share (EPS) declined year over year (YoY), and revenue witnessed a modest 2.4% growth.

Here’s how the key financial and operating metrics compare with the consensus and the prior year period:

- Adjusted EPS: $0.74 vs. last year’s $0.81 and in line with the Finchat-compiled consensus

- Revenue: $13.5 billion vs. last year’s $13.2 billion and $13.35-billion consensus

- Non-GAAP operating margin: 7.3% Vs. last year’s 8.4%

The bottom line surrounded the company’s guidance of $0.70-$0.76.

HP said it generated a free cash flow of $0.1 billion for the fourth quarter.

CEO Enrique Lores said, “We are pleased with our Q1 performance, achieving revenue growth for the third straight quarter.”

The executive said the progress was fueled by a strong commercial business in Personal Systems and momentum in its key growth areas, including artificial intelligence (AI) PCs.

Personal Systems revenue rose 5% YoY to $9.2 billion, with a 10% increase in commercial net revenue helping to offset the 7% decline in consumer business. Total PC units sold fell 1%.

Printing revenue declined 2% to $4.3 billion.

CFO Karen Parkhill said, “In Q1 we drove solid progress against our financial commitments for the year and are raising our Future Ready savings target from $1.6 to $1.9 billion dollars by the end of fiscal year 2025.”

In a 8-K filing the SEC, HP said it expects incremental workforce reductions of about 1,000 to 2,000 following the amendment to the restructuring plan.

HP first announced the restructuring initiatives in Nov. 2022 amid the macroeconomic uncertainties that clouded the demand outlook. It initially aimed to eliminate about 7,000 employees.

Looking ahead, HP said it expects second-quarter non-GAAP EPS of $0.75-$0.85, compared to the $0.85 per share consensus estimate.

The full-year adjusted EPS was maintained at $3.45 to $3.75, surrounded the $3.59 per share average analysts’ estimate. The company expects to generate free cash flow of $3.2 billion to $3.6 billion for the year.

The company said the guidance reflected additional costs driven by the current U.S. tariff increases on China and associated mitigations. The Donald Trump administration has announced a 10% tariff on imports from China, and has threatened to slap more.

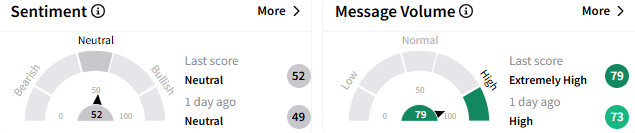

On Stocktwits, sentiment toward HP stock remained ‘neutral’ (52/100) and the message volume spurted to an ‘extremely high’ level amid the earnings release.

HP stock fell 3.86% in the after-hours session to $31.85. The stock has gained 1.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_1ebecab605.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_5257ead046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)