Advertisement|Remove ads.

Eli Lilly Stock Defies Trump’s GLP-1 Pricing Pressure With 6-Day Rally As Wall Street Cheers FDA Boost And New Weight-Loss Drug Data

- Bank of America called Lilly’s GLP-1 pricing deal “probably a good tradeoff overall,” keeping a ‘Buy’ rating and $950 target.

- The FDA granted a National Priority Voucher for Lilly’s Orforglipron as the company reported 20% weight loss in a Phase 2 trial of eloralintide.

- Retail investors on Stocktwits stayed bullish, with some predicting the stock could hit $1,000 within weeks.

Eli Lilly notched a sixth day of gains on Thursday, shrugging off concerns over U.S. President Donald Trump’s GLP-1 pricing plan as upbeat data and regulatory momentum lifted sentiment around its obesity drugs.

Bank of America Securities said Lilly’s press release described the price concessions as “less onerous than what was just discussed at the White House press conference.” The firm said the deal was “probably a good tradeoff overall,” made no changes to its forecasts, and maintained a ‘Buy’ rating and $950 price target on the shares.

Trump announced the agreements with Eli Lilly and Novo Nordisk to cut prices on GLP-1 weight-loss drugs in return for a three-year U.S. tariff reprieve.

FDA Adds Tailwind

The U.S. Food and Drug Administration awarded six additional National Priority Vouchers under its pilot program. The recipients included Eli Lilly’s Orforglipron for obesity and related health conditions, Novo Nordisk’s Wegovy, Johnson & Johnson’s Bedaquiline, GlaxoSmithKline’s Dostarlimab, Boehringer Ingelheim’s Zongertinib, and Casgevy for sickle-cell disease manufactured by Vertex Pharmaceuticals and CRISPR Therapeutics.

Strong Data From Eloralintide Trial

Eli Lilly also announced results from a Phase 2 trial of eloralintide, an investigational once-weekly, selective amylin receptor agonist for adults with obesity or overweight and at least one obesity-related comorbidity.

After 48 weeks, all treatment arms achieved superior mean weight reductions of 9.5% to 20.1%, compared with 0.4% for placebo. The company said it will begin enrolling Phase 3 clinical studies for the treatment of obesity next month.

Kenneth Custer, executive vice president and president of Lilly Cardiometabolic Health, said eloralintide “offers the potential for strong efficacy with improved tolerability” and could serve as an alternative or complementary option to incretin therapies.

Stocktwits Users Call Eli Lilly A Long-Term Winner

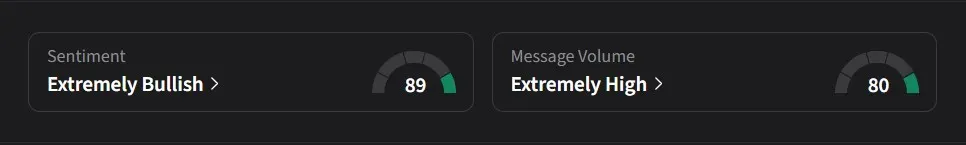

On Stocktwits, retail sentiment for Eli Lilly was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user predicted the stock could reach $1,000 within two weeks.

Another said that while the shares may face short-term swings, Lilly remains a long-term winner, adding that demand for weight-loss medications in the U.S. will be strong if the treatments become more affordable.

Eli Lilly’s stock has risen 22% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)