Advertisement|Remove ads.

Elliott Calls Emerson's Proposal To Acquire Aspen Tech ‘Deeply Flawed Process,’ Discloses Intent To Pursue All Appropriate Remedies

Activist investor Elliott Investment Management, which has a $1.5 billion stake in Aspen Technology, Inc. (AZPN), said on Wednesday it would take all appropriate remedies against Emerson Electric Co. (EMR), which is in the process of acquiring Aspen.

“Emerson's proposal to acquire AspenTech is clearly the result of a conflicted and deeply flawed process, bearing all the hallmarks of an opportunistic minority squeeze-out. Furthermore, Emerson's public statements and actions leading up to the commencement of the tender offer underscore its coercive intent toward minority stockholders,” Elliott said in a statement.

The activist investor asserted that the transaction is unfair to minority stockholders, and it intends to pursue all appropriate remedies against Emerson.

Last week, Emerson Electric said its $265 apiece offer for acquiring all outstanding shares of Aspen's common stock not already owned is its best and final price. Emerson currently owns approximately 57% of Aspen Tech's outstanding shares of common stock following its 55% majority investment completed in 2022.

Emerson stated that the price had been actively negotiated between the company and the AspenTech Special Committee for almost three months.

“The Special Committee took advice from its independent financial and legal advisors and unanimously recommends the transaction and deems it superior to AspenTech's standalone prospects,” it said.

Emerson also stated that AspenTech stockholders should decide to tender, understanding that the economic terms of the transaction will not change, and there is no assurance that Emerson will extend its tender offer should the terms or conditions of the definitive agreement not be met.

“Should the tender offer expire without the majority of the minority condition being met, Emerson has no interest in a disposition or sale of its holdings and will maintain its majority ownership stake in and governance rights related to AspenTech, which will remain a publicly traded controlled company,” it said.

Emerson’s statement came in response to Elliott’s remarks that it doesn’t agree with the price offered by Emerson to acquire Aspen Technology and considers it ‘highly opportunistic.’

"As the largest minority investor in AspenTech, we disagree with the company's decision to support a $265 per share tender offer by its majority stockholder, Emerson, to acquire the AspenTech shares it does not already own. Emerson's offer is highly opportunistic and substantially undervalues the company. Elliott has no intention of tendering its shares at the current price,” Elliott had stated earlier.

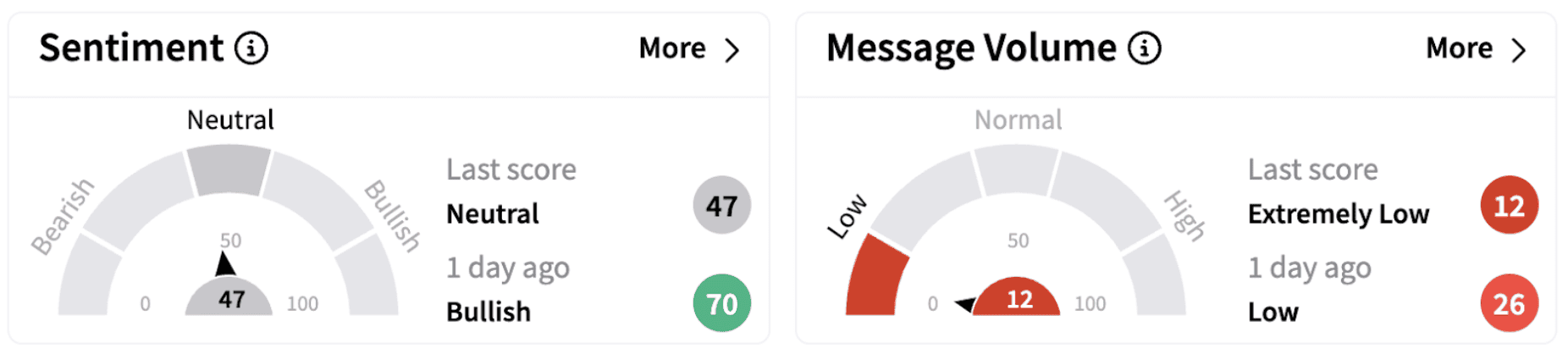

Amid all the back-and-forth statements by the acquirer and the activist investor, retail sentiment on Stocktwits surrounding AZPN stock dipped into the ‘neutral’ territory (47/100) from ‘bullish’ a day ago.

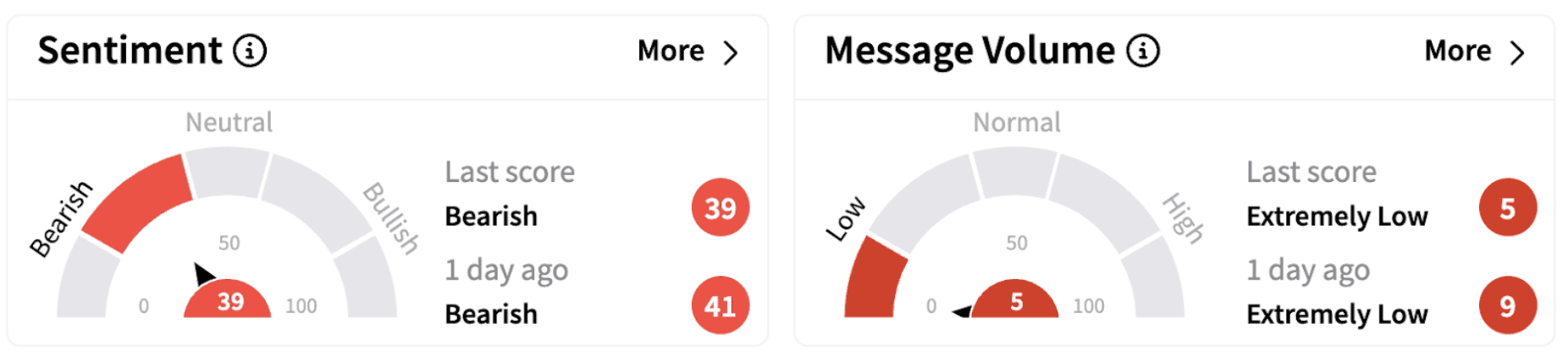

For Emerson, retail sentiment dipped further into the ‘bearish’ territory.

AZPN shares have gained nearly 6% in 2025 and over 51% over the past year. The stock is currently trading very close to Emerson’s offer of $265 apiece.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217223717_jpg_e05dddbc9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sea_ltd_jpg_b4cc09a88d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)