Advertisement|Remove ads.

Moody’s Stock In Spotlight After UBS, BMO Capital Raise Price Targets Following Upbeat Q4: Retail Stays Extremely Bullish

Shares of Moody's Corp (MCO) were in the spotlight on Tuesday after two brokerages raised their price targets on the stock following the company’s upbeat fourth-quarter earnings and positive guidance.

Last week, Moody’s reported adjusted earnings per share (EPS) of $2.62 compared to a Street estimate of $2.58. Revenue rose 13% year-over-year (YoY) to $1.67 billion but fell short of an analyst estimate of $1.71 billion, according to FinChat data. Net income rose 16% YoY to $395 million during the quarter.

CFO Noémie Heuland said that for 2025, the company expects revenue growth in the high-single-digit percent range and adjusted diluted EPS in the range of $14.00 to $14.50. Wall Street expects annual EPS at $13.59.

According to TheFly, BMO Capital raised the firm's price target on Moody's to $531 from $481 while keeping a ‘Market Perform’ rating on the shares. At the same time, UBS raised the firm's price target on the stock to $540 from $510 while maintaining a ‘Neutral’ rating.

According to UBS, the shares outperformed following the fourth-quarter (Q4) results due to strong FY25 guidance, particularly for margin expansion. The brokerage noted that with the valuation elevated, it does not see much room for upside, given optimistic guidance.

Moody’s board of directors declared a regular quarterly dividend of $0.94 per share, representing an 11% increase from the prior quarterly dividend of $0.85 per share.

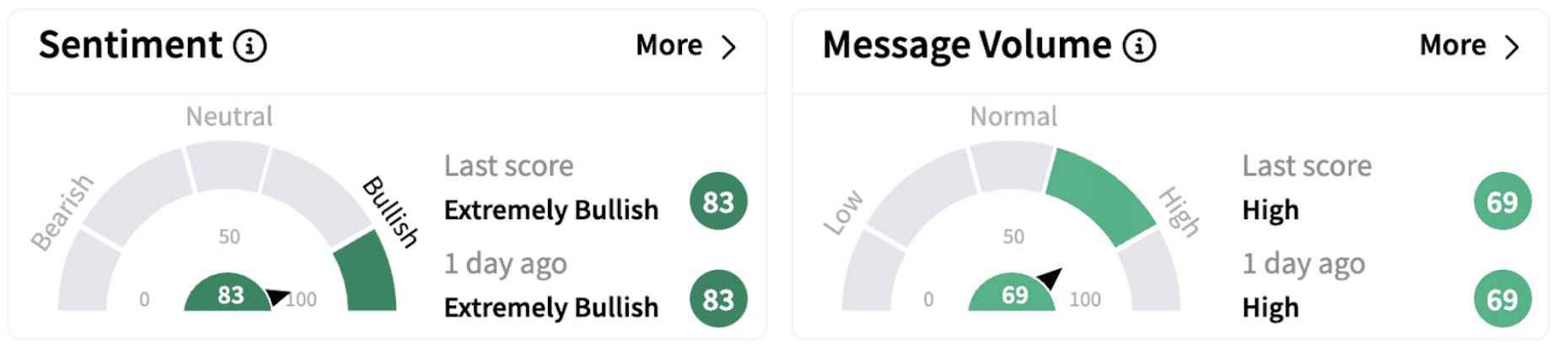

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory (83/100), accompanied by ‘high’ retail chatter.

MCO shares have gained over 9% in 2025 and are up over 38% over the past year.

Also See: Fed’s Mary Daly Reportedly Says Policy Needs To Be Restrictive Until There’s Progress On Inflation

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)