Advertisement|Remove ads.

Tesla Stock Down Over 20% Since Trump's Inauguration: Most Retail Traders See Musk's Politics As A Major Drag

Tesla Inc. shares have plunged more than 22% since Donald Trump's presidential inauguration on Jan. 20, reflecting waning market confidence in the EV giant.

CEO Elon Musk remains a busy man, juggling leadership roles at SpaceX, AI startup xAI, The Boring Company, and Neuralink.

He also serves as CTO of X (formerly Twitter), which he acquired for $44 billion in 2022.

But his latest venture — a leadership role in Trump's newly created Department of Government Efficiency (DOGE), tasked with cutting federal spending — has caused stronger ripples.

Retail traders have noticed that Musk's political entanglements coincide with declining Tesla sales in key markets like China, Europe, and parts of the U.S.

His public endorsement of Germany's far-right Alternative for Germany party and criticism of UK Prime Minister Keir Starmer have also fueled controversy.

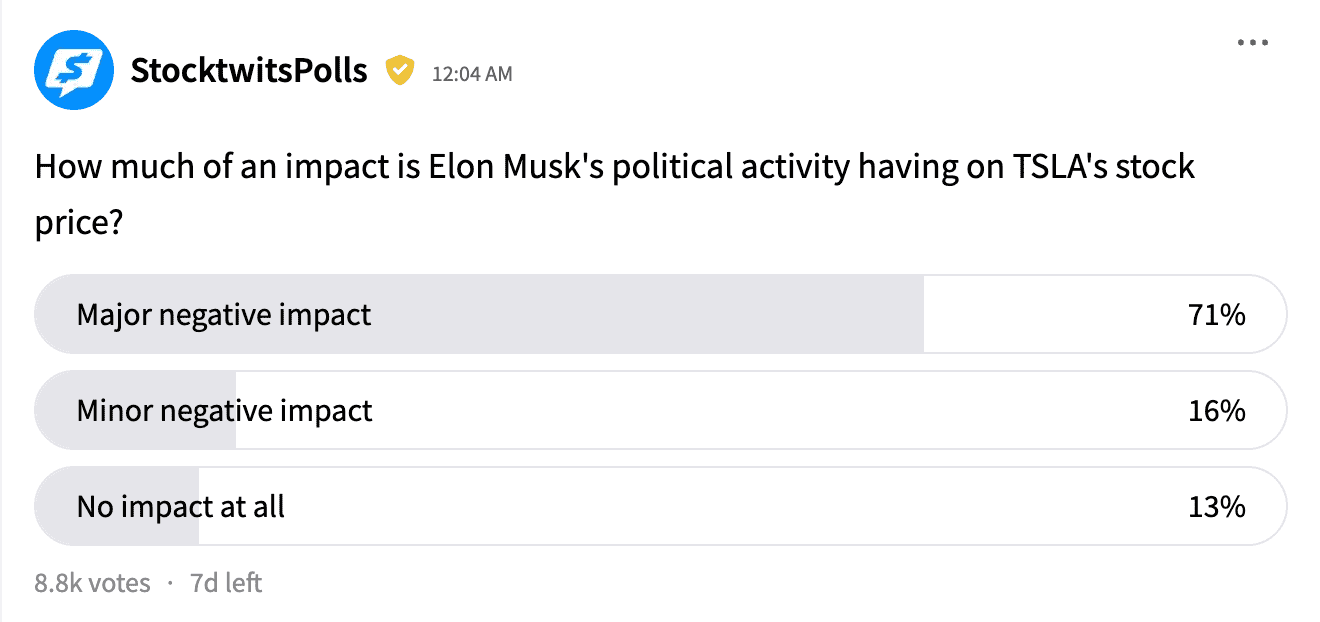

A Stocktwits poll reveals that 71% of more than 8,500 respondents believe Musk's political activity is a "major negative" for the stock, while 16% see only a minor impact and 13% say there's no effect.

"This will go down in history books and business classes worldwide. Never mix business with politics — it's always detrimental and could bankrupt your business," one user wrote.

"His fans will call it a masterful gambit, but I'll tell you it's bad practice to purposely alienate your core customer base," said another.

Retail traders also agree with analysts' views that Musk's $97.4 billion bid to acquire OpenAI — which he co-founded with Sam Altman — further distracts him from his responsibilities to Tesla shareholders.

Adding to the pressure, Chinese EV giant BYD announced this week that it would offer free smart-driving tech in its lower-cost models and integrate DeepSeek AI. Tesla is still awaiting approval to trial Full Self-Driving in China.

Analysts warn that Musk's political involvement risks alienating consumers and employees.

Tesla already missed its 2024 delivery target, along with fourth-quarter revenue and profit estimates.

While Musk is pushing Tesla's AI and robotics ambitions, concerns over execution remain.

Tesla stock currently trades at a whopping 113 times estimated 2025 earnings.

However, the company's shares are just about 3% above analysts' average price target of $340.37, signaling fading confidence from Wall Street after the post-election rally.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)