Advertisement|Remove ads.

‘Too Late’ For Oracle, Warns Michael Burry As ORCL Stock Down Over 50% From September Peak

- Oracle’s debt-fueled infrastructure expansion, to support new customer demand, has raised concerns.

- Burry said Oracle “didn’t have to do this,” referring to its $300 billion deal with OpenAI.

- ORCL stock is down by over 50% since its Sept. 10 peak.

Noted investor Michael Burry, known for shorting the 2008 subprime mortgage crisis, has struck a decidedly pessimistic tone on Oracle Corp. as the software giant faces mounting scrutiny over its debt-heavy push into data-center expansion to support a new wave of business commitments.

Oracle In Soup

Investors are particularly worried about what they see as Oracle’s overreliance on OpenAI, given the tech giant’s smaller footprint in the cloud computing market dominated by Amazon, Microsoft, and Google.

In September, Oracle announced a five-year, $300-billion deal to supply computing services to OpenAI, and two months later reported that its remaining performance obligations (orders secured but not completed yet) jumped to $523 billion, or nine times its revenue in the last four quarters.

While the 438% jump in RPO lifted sentiment about future business gains, it also raised concerns that most of it is coming from a single customer. Investors are also punishing Oracle for taking on huge debts. The stock has slumped over 50% since its Sept. 10 peak of $328.33, and on Sunday announced plans to raise up to $50 billion in debt and equity this year, adding to investor jitters.

What Does Burry Have To Say?

“I’ll say it again. Oracle didn’t need to do this… Now it is too late,” Burry said in a post on his Substack stream late Monday, responding to a news article about Oracle’s reliance on OpenAI.

“I don’t know why it did this. It had a great business. It didn’t have to buy Cerner. And it did not have to do this,” he said, referring to Oracle’s $28.3 billion acquisition of the healthcare software firm in 2022.

Interestingly, TD Cowen recently speculated that Oracle’s management may be exploring a divestment of Cerner, alongside plans to cut Oracle’s workforce by about 18%, as part of efforts to shore up its financial profile amid debt concerns.

To be sure, Burry has been bearish on Oracle for some time. Last month, he disclosed put options on ORCL and said he has been shorting Oracle directly for about six months, citing skepticism about its cloud strategy, rising debt, and valuation. Months ago, he alleged the company was understating depreciation on AI and cloud infrastructure assets, and artificially boosting its reported earnings.

Stock Move, Retail Reaction

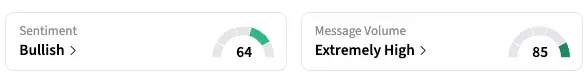

Oracle stock declined 2.8% on Monday, its fifth straight session of losses. On Stockwits, the retail for the stock slipped to ‘bullish’ from ‘extremely bearish’ the previous day.

The sentiment was also weighed by uncertainty around a major partnership between OpenAI and Nvidia.

Oracle stock has declined nearly 18% so far this year. It rose 17% over 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Is Nvidia’s $100B Deal With OpenAI Stalled? Altman, Huang And Oracle Try To Calm Market Jitters

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)