Advertisement|Remove ads.

Enbridge Stock Falls After Company Reports Significant Decline In Net Income: Retail Shrugs It Off

Enbridge (ENB) stock garnered retail attention on Friday after the Canadian firm’s fourth-quarter earnings topped analysts’ estimates.

According to FinChat data, Enbridge reported adjusted earnings of C$0.75 ($0.53) per share for the fourth quarter, compared with estimates of C$0.74 per share.

However, its net income fell to C$493 million from C$1.73 billion, primarily due to non-cash, unrealized changes in hedges and the absence in 2024 of non-cash gains recorded from the discontinuation of rate-regulated accounting for the Southern Lights Pipeline.

The stock was down 2.8% in morning trade.

Companies use hedging, which essentially sets a fixed price for commodities, to negate volatility.

Enbridge attributed the rise in adjusted earnings to higher tolls from its Mainline system, which transports the bulk of Canadian crude into the U.S., and higher contributions from acquisitions. Last year, Enbridge acquired three natural gas utilities from Dominion Energy.

Its quarterly adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from its liquids pipeline segment rose marginally to $2.4 billion.

The mainline pipeline volumes declined to 3.1 million barrels per day (bpd) from 3.2 million bpd in the year-ago quarter.

Its adjusted EBITDA in the gas distribution and storage segment jumped to C$1.02 billion from C$519 million last year.

The company’s gas transmission business earnings also rose to C$1.27 billion from C$1.08 billion, aided by favorable contracting and lower operating costs at its U.S. Gas Transmission assets and acquisitions of several gas storage facilities.

Enbridge reaffirmed its 2025 forecast for adjusted EBITDA between $19.4 billion and $20.0 billion.

The company added about C$8 billion of new organic growth projects to its backlog in 2024. Its total growth project backlog stands at C$26 billion.

Enbridge also raised its quarterly dividend by 3%.

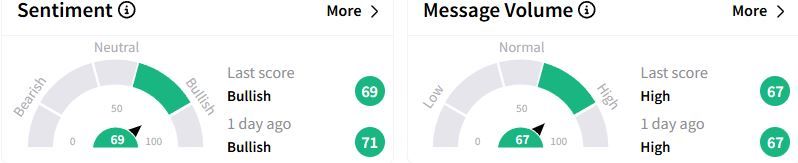

Retail sentiment on Stocktwits remained in the ‘bullish’ (69/100) territory, albeit with a lower score than a day ago, while retail chatter was ‘high.’

One user disclosed a long position in the shares and praised the stock’s dividend yield.

Over the past year, Enbridge stock has gained 29%.

(1 Canadian dollar = 0.71 U.S. dollar)

Also See: Ingersoll-Rand Stock In Spotlight After Q4 Revenue Miss: Retail Stays Neutral

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)