Advertisement|Remove ads.

Energy Transfer Stock Falls After-market On Q4 Revenue Miss: Retail Shrugs It Off

Energy Transfer (ET) stock fell nearly 2% in after-market trade on Tuesday after the company’s fourth-quarter revenue missed Wall Street’s estimate.

According to Koyfin data, the company reported fourth-quarter revenue of $19.54 billion, missing the average analysts’ estimate of $21.41 billion.

Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $3.88 billion also fell short of Wall Street’s estimate of $3.97 billion.

Lower transportation revenue, primarily from the Bakken pipeline, and reduced marketing earnings hurt the company's bottom line.

The company’s crude oil transportation volumes rose 15% during the fourth quarter compared to the same period last year, aided by higher volumes in the Permian basin.

According to the Energy Information Administration data, U.S. oil production hit a fresh record in 2024, aided by robust growth in the Permian, the largest shale oilfield in the U.S.

Gas transported on the company’s Texas and Oklahoma intrastate pipelines decreased primarily due to less third-party transportation and reduced gas production from the Haynesville area.

Energy Transfer projected its 2025 Adjusted EBITDA between $16.1 billion and $16.5 billion. Analysts are expecting $16.37 billion in core earnings.

For 2025, the company expects its growth capital expenditures to be about $5 billion.

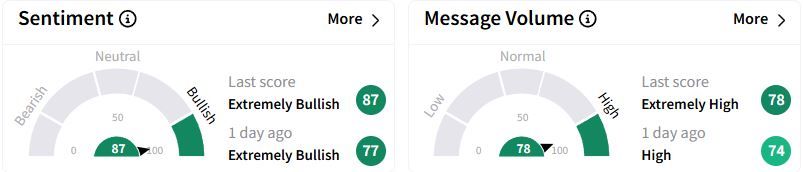

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (87/100) territory than a day ago, while retail chatter rose to ‘extremely high.’

Some users encouraged others to buy its shares as the stock declined.

Earlier in February, the company signed a natural gas supply agreement with Denver-based CloudBurst Data Centers for an AI-focused data center outside of San Marcos, Texas.

During the quarterly earnings call, the company said it has received requests from over 70 prospective data centers in 12 states.

The company also said it expects to reach a final investment decision on its Lake Charles liquefied natural gas project in the fourth quarter.

Over the past year, Energy Transfer stock has gained 40.6%.

Also See: Lyft Stock Tumbles On Soft Q1 Forecast, But Retail Sentiment Rises To Year-High After Q4 Sales Beat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)