Advertisement|Remove ads.

Ensysce Biosciences Stock Rises On Positive Data From Opioid Overdose Protection Study: Retail’s Thrilled

Shares of Ensysce Biosciences, Inc. (ENSC) traded nearly 11% higher on Tuesday afternoon after the company said its PF614-MPAR pain relief medication demonstrated in a study that it can deliver strong relief for severe pain while protecting from the risk of excessive doses.

The company completed the first part of its second clinical trial to evaluate PF614-MPAR for overdose protection. It confirmed that a 100 mg dosage of PF614-MPAR delivers oxycodone to treat severe pain and provides overdose protection when a greater-than-prescribed dose is consumed.

CEO Bill Schmidt said that the clinical data demonstrates the ability of the company’s Multi-Pill Abuse Resistance (MPAR) platform as a vital tool to limit overdoses from prescription medications.

Ensysce said that the maximum amount of oxycodone released from PF614-MPAR when three or more doses were taken at one time was reduced compared to that released following the consumption of the same amount of PF614 alone.

The company said that the new data demonstrates overdose protection across the full dosage range of PF614-MPAR, which is planned for commercialization. It added that this analysis will be discussed with the U.S. Food and Drug Administration (FDA) in an upcoming meeting.

The company will now continue to enroll for parts 2 and 3 of the clinical trial, which will allow it to perfect a final drug product for commercialization.

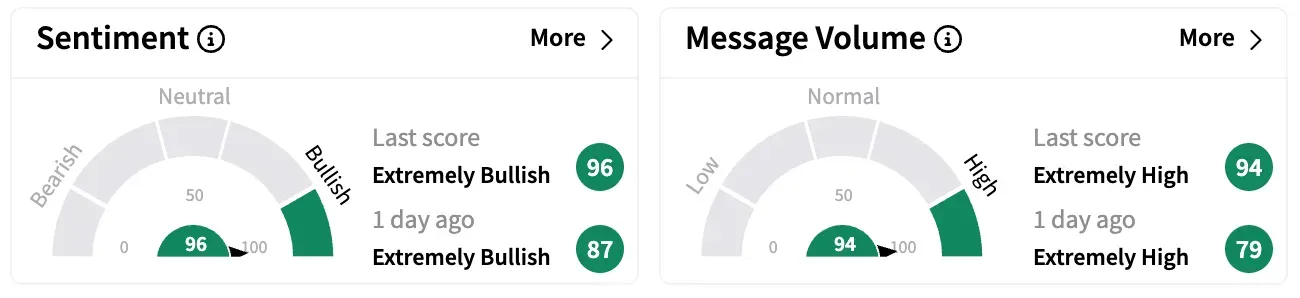

On Stocktwits, retail sentiment around Ensysce Biosciences jumped nine points in the ‘extremely bullish’ territory while message volume remained ‘extremely high.’

A Stocktwits user expressed optimism about the shares rallying to $6 from their current $2 levels.

ENSC stock is down nearly 73% year-to-date and about 78% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)