Advertisement|Remove ads.

Barclays Downgrades US Auto Sector Owing To Trump’s Tariffs: Retail Sentiment Around GM Takes A Plunge

Barclays, on Tuesday, downgraded the U.S. autos and mobility sector to ‘Negative’ from ‘Neutral’ in light of the impact of Trump’s tariffs.

A "highly challenging environment" makes a near-term investment case for the autos sector "increasingly difficult," the analyst said, as per TheFly.

The firm sees multiple near-term pressures, including earnings pressure, risks to consumer health, and a cloud over auto tech investment.

"Auto tariffs are seemingly here to stay, and valuations are seemingly not pricing in full tariff risk," Barclays said.

Trump said on Monday that he is looking to “help some of the car companies” as automakers “need a little bit of time” to move their production to the U.S., raising hopes among investors for some reprieve in the tariffs.

On Tuesday, Barclays lowered its price target on Ford Motor Co. to $8 from $10 while keeping an ‘Equal Weight’ rating on the shares.

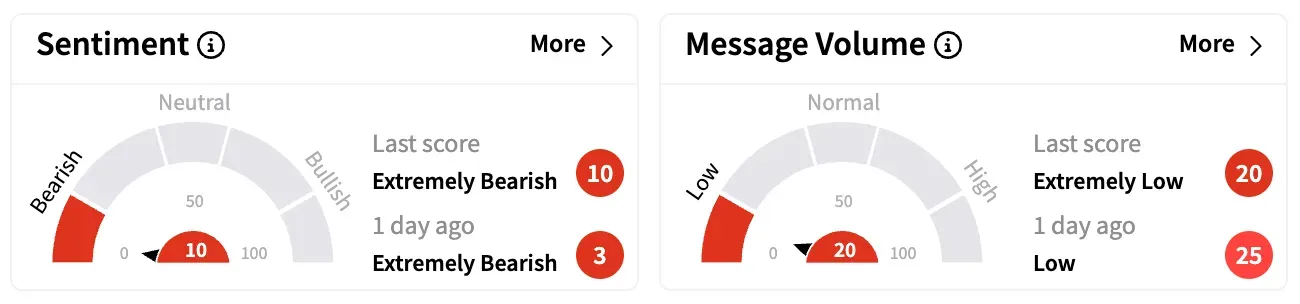

On Stocktwits, retail sentiment around Ford rose seven points while staying within the ‘extremely bearish’ territory over the past 24 hours.

The brokerage also downgraded General Motors (GM) to ‘Equal Weight’ from ‘Overweight’ with a price target of $40, down from $70, to reflect the company's "significant risk" to near-term earnings from tariffs.

The new price target implies a near 10% downside to GM’s closing share price of $44.63 on Monday.

The brokerage said that it maintains a slight preference for Ford over GM.

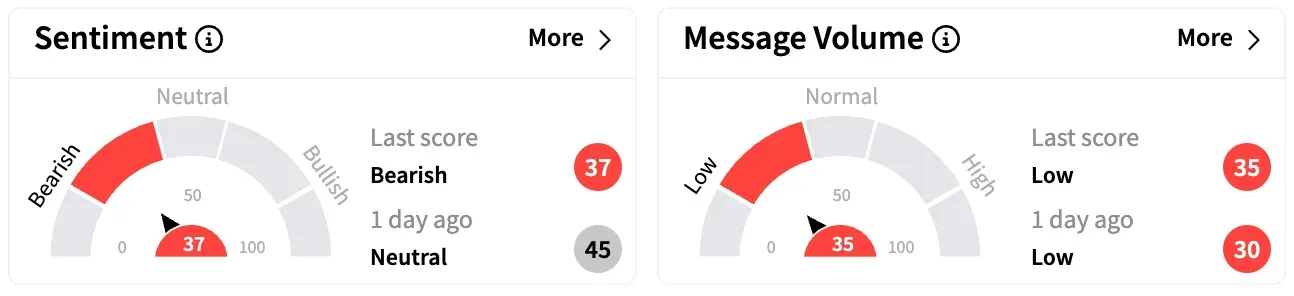

Retail sentiment around GM on Stocktwits fell from ‘neutral’ to ‘bearish’ over the past 24 hours while message volume remained at ‘low’ levels.

Last week, Goldman Sachs also cut its estimates for automobile sales in the U.S. in 2025 by nearly one million to 15.40 million units in light of Trump’s tariffs while simultaneously slashing price targets on multiple automakers.

While F stock has lost about 23% over the past 12 months, GM stock has gained nearly 4%.

Also See: Lucid To Launch Midsize SUV In 2026, Says Report: Retail Holds On To Optimism

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)