Advertisement|Remove ads.

EOG Resources Tops Q1 Profit Estimates, Trims 2025 Capex On Tariff Uncertainty: Retail’s Divided

EOG Resources (EOG) stock would likely draw retail attention on Friday as the oil and gas company topped Wall Street’s estimates for first-quarter earnings and lowered its 2025 capital expenditure budget.

On an adjusted basis, the company reported a net income of $2.87 per share for the three months ended March 31, while analysts expected it to post $2.77 per share in earnings, according to FinChat data.

Its quarterly revenue of $5.67 billion missed Wall Street’s expectations of $5.86 billion.

The energy firm’s total crude oil production averaged 1.09 million barrels of oil equivalent per day (boepd) for the first quarter, compared with 1.03 million boepd a year earlier.

EOG recorded higher crude oil, natural gas, and natural gas liquids (NGL) prices in the first quarter compared to the previous quarter.

“The company’s financial position provides EOG the ability to return greater than 100% of annual free cash flow in the near term,” CEO Ezra Yacob said.

EOG, one of the biggest shale oil producers, also lowered its full-year capital expenditure plan to a range of $5.8 billion to $6.2 billion, a $200 million reduction at the midpoint due to tariff-related discussions.

The company also said it expects to maintain oil production at first-quarter 2025 levels for the rest of the year and deliver full-year oil production growth of 2% and total production growth of 5%.

Several analysts have forecast that benchmark crude will remain below $65 per barrel in 2025, a price level at which oil producers are unable to raise production.

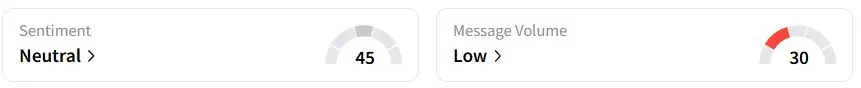

Retail sentiment on Stocktwits was in the ‘neutral’ (45/100), while retail chatter remained ‘low.’

EOG stock has fallen 9.9% year to date (YTD) compared to a 6.3% decline of the S&P 500 energy sector.

Also See: Apple Warns Of $900M Tariff Hit Despite Q2 Beat: Stock Dips But Retail Holds Bullish Ground

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)