Advertisement|Remove ads.

ETWO Stock Rises Ahead Of Earnings: Retail Remains Neutral

SaaS-based supply chain software maker E2Open Parent Holdings’ stock was up nearly 1% on Wednesday before the company’s second-quarter earnings release, eliciting a neutral stance from retail investors.

Analyst estimates for its earnings stand at about $0.02 on revenue of $154.8 million. The company missed analyst estimates in the previous quarterly earnings. However, for its fiscal 2024 annual earnings, its EPS performance beat analyst estimates.

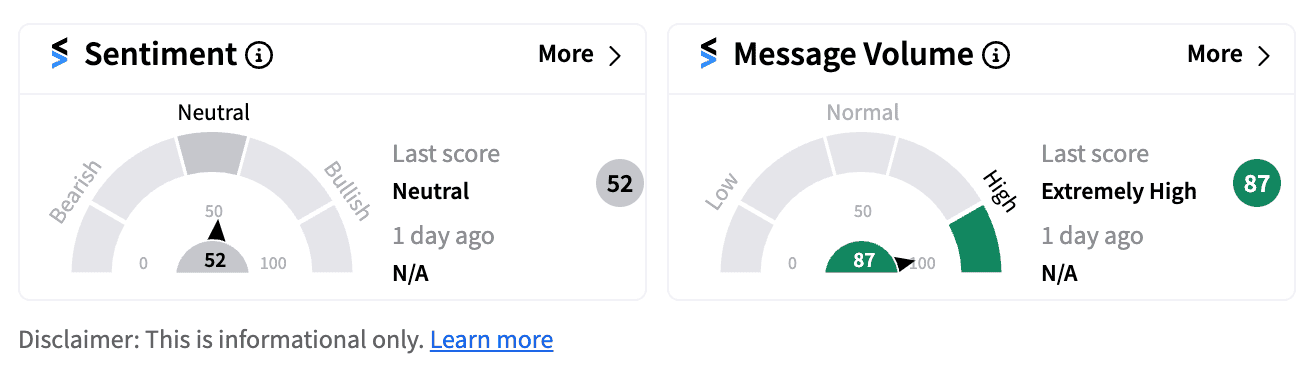

Sentiment on the stock was ‘neutral’ (52/100) while the message volume was ‘extremely high’. (87/100).

In July, the company reaffirmed its guidance for fiscal 2025, with subscription revenue expected to range between $532 million and $542 million, reflecting flat growth year-on-year.

For the fiscal second quarter of 2025, it expects a range of $129 million and $132 million, reflecting a negative 3.1% organic growth rate at the midpoint, the company said in an earlier statement

E2Open, which serves a variety of industries including technology, food and beverage, and pharmaceuticals has seen its stock dwindle 7.3% year-to-date. It is significantly below the $13.38 price it saw in 2021.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1061406346_jpg_1af8a0eae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_again_dcd66ed9d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_william_li_nio_jpg_c26eaad557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243094578_jpg_0f996b2394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)