Advertisement|Remove ads.

Extra Space Storage Stock Rises After Upbeat Q4 Core FFO, Retail Sits On The Fence

Extra Space Storage (EXR) stock rose 1.1% in extended trade after the company’s fourth-quarter core funds from operations (FFO) topped Wall Street’s estimates on Tuesday.

The company reported a core FFO, a metric used to gauge the profitability of real estate firms, of $2.03 per share, while analysts, on average, expected it to report $2.02 per share.

Extra Space Storage posted a net income of $262.49 million, or $1.24 per share, compared with $216.13 million, or $1.02 per share for the three months ended Dec. 31.

The Salt Lake City-based firm’s same-store revenue fell by 0.4%, and same-store net operating income declined by 3.5% compared to the year-ago quarter.

As of Dec. 31, its same-store occupancy was 93.7%, compared with 92.5% last year.

The company bought 38 operating stores for a total cost of about $359.7 million during the fourth quarter.

Elevated interest rates have raised the borrowing costs for real estate firms. The company said that the macro environment remained challenging during the quarter.

"We expect much of the same in 2025 – a challenging but slowly improving operating environment,” CEO Joe Margolis said.

The company expects same-store revenue growth between negative 0.75% and 1.25% in 2025.

It also projected core FFO between $8 and $8.30 per share in 2025. Analysts expect the company to post a core FFO of $8.28 per share.

On Monday, Rival Public Storage missed Wall Street’s estimates for core FFO.

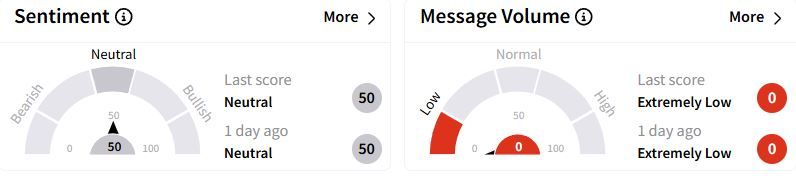

Retail sentiment on Stocktwits remained in the ‘neutral’ (50/100) territory, while retail chatter was ‘extremely low.’

Over the past year, Extra Storage stock has gained 15.6%.

Also See: Par Pacific Stock Slips After-Hours On Swinging To Q4 Loss, But Retail Traders Brush It Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)