Advertisement|Remove ads.

Par Pacific Stock Slips After-Hours On Swinging To Q4 Loss, But Retail Traders Brush It Off

Par Pacific (PARR) stock fell 2.7% in after-hours trade on Tuesday after the company posted a net loss for the fourth quarter compared with a year-ago profit.

For the three months ended Dec. 31, the refiner posted a net loss of $55.7 million, or $1.01 per share, compared with a net income of $289.3 million, or $4.77 per share.

According to FinChat data, the company reported a net loss of $0.79 per share on an adjusted basis for the fourth quarter, while analysts, on average, expected it to post a loss of $0.97 per share.

Its quarterly revenue of $1.83 billion topped Wall Street’s estimated $1.68 billion.

The company’s refining segment posted an operating loss of $65.4 million, compared with an operating income of $174 million last year.

Global refining margins have slipped from record highs post Russia’s invasion of Ukraine due to a rise in refining capacity and lukewarm demand in major economies, including China.

Par Pacific said, on average, it processed 187,800 barrels per day (bpd) of crude during the quarter, compared with 186,000 bpd last year. It operates four refineries with a total capacity of 219,000 bpd.

The company, which has 120 fuel retail locations in Hawaii and the Pacific Northwest, said its retail sales volumes rose to 30.29 million barrels from 29.84 million barrels last year.

The Houston-based company said it expects to restart its idled refinery in Wyoming in mid-April at reduced throughput and return to full operations by the end of May.

The plant is the smallest among its four refineries and has a crude processing capacity of 20,000 bpd.

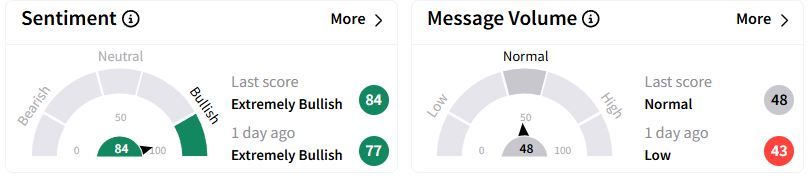

Retail sentiment on Stocktwits moved higher into the ‘extremely bullish’ (84/100) territory than a day ago, while retail chatter climbed to ‘normal.’

Peer PBF Energy had also posted a quarterly loss earlier in February.

Over the past year, Par Pacific stock has fallen 60.5%.

Also See: Axon Enterprises Stock Soars Aftermarket As Q4 Profit Tops Expectations, Retail’s Delighted

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)