Advertisement|Remove ads.

Fashion Might Be The Only Thing Saving Retail Right Now — Viral Ads And Bold Revamps Are Powering ANF, URBN, GAP Into Surprise Holiday Rallies

- Strong results from Abercrombie & Fitch, Gap, and Urban Outfitters power their stocks, prompting investors to revise their stance on the fashion sector.

- Innovation ad campaigns, fast-moving fresh inventory, and a sharp focus on trends boosted third-quarter performances.

- Fashion is emerging as a key growth category as broader retail trends remain mixed at best.

American consumers are cutting back on dining out and hunting for value deals at Walmart and other Big Box stores, but one corner of the retail market seems to be thriving: fashion.

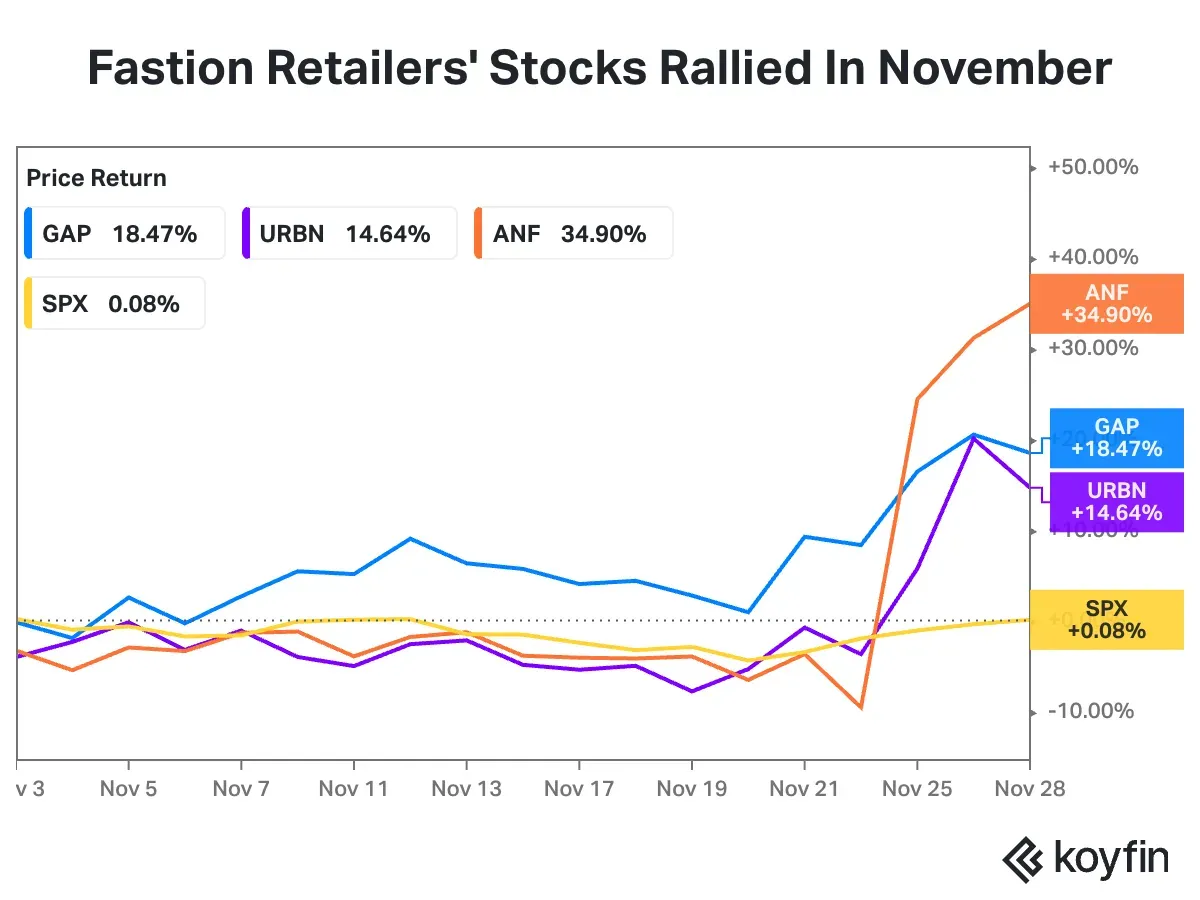

Investors were pleasantly surprised as Abercrombie & Fitch, Gap, and Urban Outfitters all surged past Wall Street estimates and issued upbeat holiday-season outlooks — prompting many to reconsider their stance on the sector.

Fashion, which includes clothes, footwear, and accessories, is typically one of the first hit categories in a downturn. The U.S. consumer faces a string of headwinds, including high inflation, job losses, and broader economic uncertainty stemming from President Donald Trump’s tariff policy – evident in weak earnings from big-box retailers like Target and home improvement retailers like Home Depot.

Record-Setting Quarter In Fashion

Although best viewed against about two years of weakness in the fashion sector, the third-quarter performances delivered a solid punch.

Abercrombie & Fitch’s shares jumped by over 37% – their lifetime best – after its report last week. Urban Outfitters reported 12.5% comparable sales growth, three times higher than expectations, and Gap notched solid marks on its turnaround report card, saying a viral campaign helped push its brands back to the top of consumer choice.

Gap’s “Better In Denim” campaign, featuring girl group Katseye, garnered 8 billion impressions and 500 million views online, and was one of the company’s “most successful campaigns to date,” CEO Richard Dickson said on the analyst call on Nov. 20.

“We've been working really hard at driving new narratives that put our brands back into the cultural conversation,” he said, adding that its new campaigns are attracting younger shoppers, especially Gen Z. With American Eagle’s edgy ads with actress Sydney Sweeney, which also went viral and boosted company sales, brands’ fresh approach to marketing seems to be doing well.

Ads, Newness Boost

Abercrombie & Fitch’s performance was driven by surprisingly healthy uptake in Hollister, its brand that sells casual, beach-inspired clothing and accessories. Net sales rose 16%, compared to a 2% drop in the namesake brand, helped by “back to school” shopping and a focus on fresh designs.

CEO Fran Horowitz said the company is also “keeping inventory tight while continuing to flow in newness, allowing for AUR improvement on lower promotions,” and recently launched a brand collaboration with college athletes. Newness is the industry term for fresh and latest fashion items, while AUR is the average price per unit.

Telsey analysts lauded ANF’s marketing push “through efforts such as its denim campaign for back-to-school, its NFL collaboration, and most recently to support its partnership with luxury western brand Kemo Sabe.”

“The brand’s inventory positioning and marketing plans for the fourth quarter are in place, and the business is well-positioned across denim, fleece, and sweaters, which have been strong categories,” they said.

Urban Outfitters, known for trendy, eclectic clothing also aimed at young consumers, posted record revenue and profit in the last quarter.

Powered by its strong results, ANF shares surged 40% last week, and sentiment on Stocktwits is currently “bullish.” URBN shares gained 15.5%, while GAP stock gained 8.5%. Their retail sentiment is ‘extremely bullish’ and ‘bearish’ respectively, as of the last reading.

Year-to-date, URBN is up 34.3%, while GAP is up 13.8%. ANF, despite last week’s rally, is still down 35.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)