Advertisement|Remove ads.

Fidelis Insurance Stock Headed Toward Worst Single-Day Decline After Disclosing Aviation Litigation, California Wildfires Impact

Shares of Fidelis Insurance Holdings (FIHL) tumbled over 11% on Thursday to hit a year-low level, headed toward their worst single-day performance, after the company disclosed the impact to its Aviation and Aerospace line of business and a preliminary catastrophe loss estimate for the January 2025 California wildfires.

Fidelis said that during the fourth quarter, the company incurred net adverse prior-year development attributable to its Aviation and Aerospace line of business of $287.2 million. This is related to business underwritten in 2021 and 2022 and has been impacted by the ongoing Russia-Ukraine aviation litigation.

The insurer said that for 2024, it anticipates reporting net income in the range of $100 to $120 million and operating net income in the range of $120 to $140 million.

The company indicated that it had been judiciously settling claims to derisk its overall exposure in terms of aviation litigation.

Fidelis also noted that it has successfully settled or is in various stages of settlement discussions regarding approximately two-thirds of the total exposure related to lessor policy claims currently in litigation.

“Of the remaining lessor policy claims in litigation, a significant portion of these claims relate to the English trial that commenced in October 2024,” it said. The trial concluded on Feb. 14, 2025, and a court judgment will be rendered in the coming months.

The company also released a preliminary estimate of catastrophe losses related to the January 2025 California wildfires.

It anticipates catastrophe loss estimates to be in the range of $160 million to $190 million, net of expected recoveries, reinstatement premiums, and tax. These losses will be reflected in its first-quarter 2025 earnings, which are scheduled to be released after the closing bell on Feb. 25.

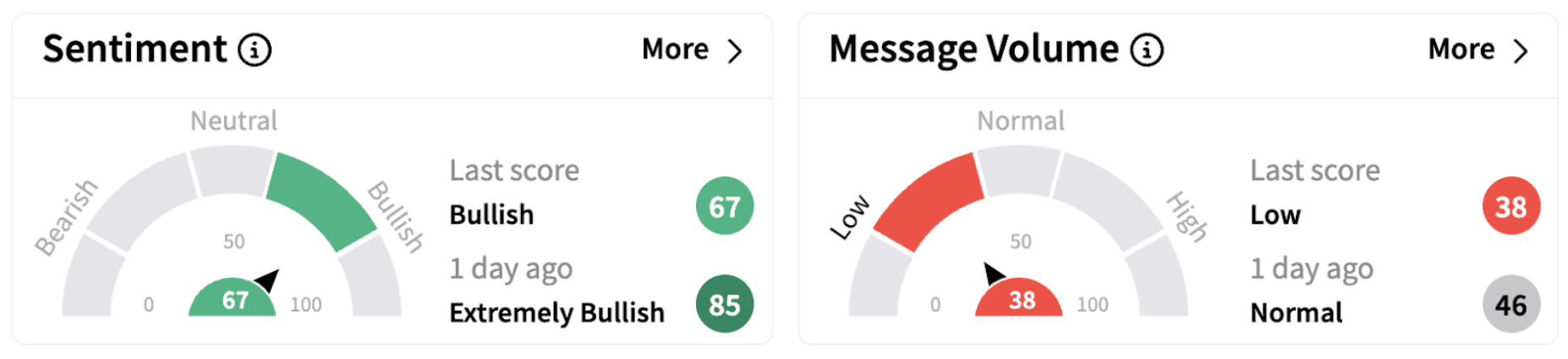

On Stocktwits, retail sentiment dipped into the ‘bullish’ territory (67/100) from ‘extremely bullish’ a day ago.

Fidelis’ shares have fallen over 18% in 2025 but are up almost 11% over the past year.

Also See: Quanta Services Stock Rallies On Strong Q4 Earnings, Outlook: Retail’s Excited

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)