Advertisement|Remove ads.

Fidelity’s Jurrien Timmer Says It’s Still ‘Early Days’ For AI Bubble Talks

- Timmer compared Nvidia’s valuations during the ongoing AI boom with those of Cisco, which was at the center of the dotcom bubble due to widespread adoption of the internet.

- The data for the S&P 500 index does show that the AI boom is following a similar trajectory to that of the dotcom boom, according to Timmer’s chart.

- Earlier, Wharton’s Jeremy Siegel also echoed similar sentiments, saying strong Big Tech earnings are driving the current rally in U.S. equities.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, on Tuesday downplayed concerns of an AI bubble amid a surge in the valuation of Nvidia Corp. (NVDA).

Timmer compared Nvidia’s valuations during the ongoing artificial intelligence (AI) boom with those of Cisco Systems Inc. (CSCO), which was at the center of the dotcom bubble, facilitated by the widespread adoption of the internet.

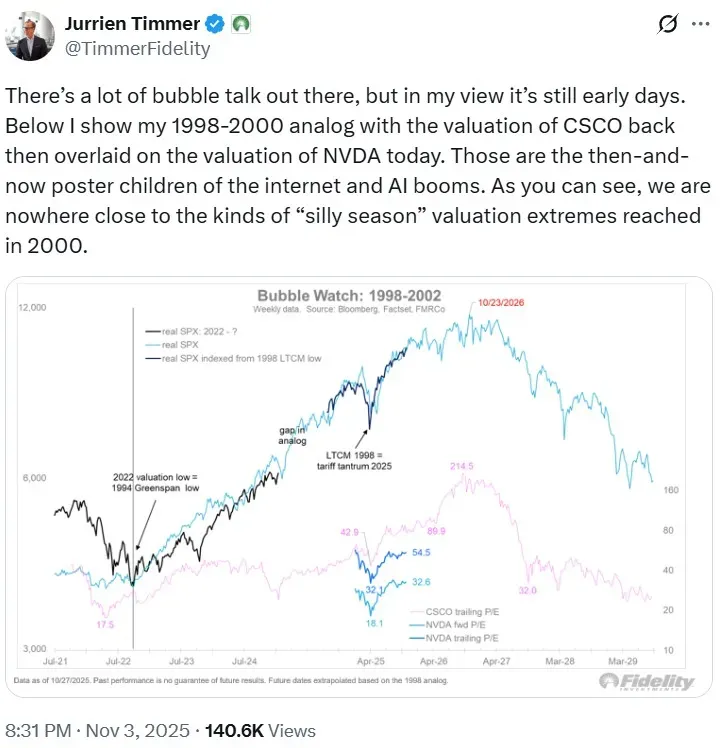

“There’s a lot of bubble talk out there, but in my view it’s still early days,” Timmer said in a post on X, overlaying Nvidia’s valuations with those of Cisco. He compared Nvidia’s price-to-earnings (P/E) ratio with Cisco’s, showing that the AI bellwether’s trailing P/E ratio is still notably lower than that of Cisco.

Nvidia’s shares were down more than 2% in Tuesday morning’s trade. Retail sentiment on Stocktwits around the company was in the ‘extremely bullish’ territory at the time of writing.

Peak Not Here Yet

Timmer’s comparison of Nvidia and Cisco’s PE ratios shows that the former’s valuations have still not risen enough for the AI boom to approach a bubble.

The data for the S&P 500 index shows that the AI boom is following a similar trajectory to that of the dot-com boom, according to Timmer’s chart. He expects the index to reach a peak in October 2026 and begin its decline thereafter. By 2029, Timmer expects the S&P 500 index to be back to its 2024 levels.

Siegel Dismisses Bubble Concerns

Echoing similar sentiments to Timmer, Jeremy Siegel, professor emeritus of finance at the University of Pennsylvania’s Wharton School of Business, dismissed concerns of an AI bubble.

In his weekly commentary, Siegel stated that the current rally in U.S. equities is driven by strong earnings from big technology companies in the latest quarter. “Earnings remain the bright spot,” he said.

Siegel added that Big Tech’s latest quarterly reports, along with the capital expenditure plans in the artificial intelligence (AI) sector for 2025-26, demonstrate that the current boom in U.S. equities is distinct from the dot-com boom of 1999. “These are real firms with real cash flows, not concept stocks,” he said.

NVDA stock is up 50% year-to-date and 48% over the past 12 months. The S&P 500 index is up 15% YTD and 19% over the past 12 months.

Also See: Alex Karp Calls Out Michael Burry’s Short Bet Against Palantir, Nvidia: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)