Advertisement|Remove ads.

Breakout Radar: These 5 Stocks Could Be The Next Big Movers, According To Finpire Capital

SEBI-registered Finpire Capital has recommended five stocks: Bajaj Healthcare, Deccan Cements, Gabriel, Krishna Institute of Medical Sciences, and SBFC Finance, based on technical breakouts, volume spikes, and visible accumulation zones.

Finpire believes that these stocks are showing signs of explosive upside. Here's a breakdown of the outlook on each:

1. Bajaj Healthcare

Finpire says Bajaj Healthcare has been forming a tight box range between ₹503 and ₹712, indicating strong coiling action often preceding explosive moves.

They recommend entering above ₹725 and believe that a move beyond this could unlock a sharp upside toward ₹900–₹1000.

In recent developments, the company expanded its API manufacturing footprint by acquiring Genrx Pharmaceuticals for ₹10.85 crores.

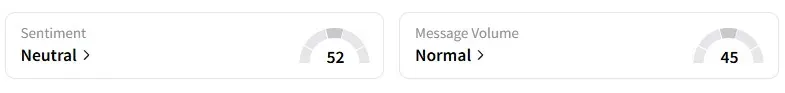

Data on Stocktwits shows that retail sentiment is 'neutral' with low message volume.

Bajaj Healthcare stock has gained 10% year to date (YTD).

2. Deccan Cements

Cement stocks have seen renewed interest in recent weeks, and Deccan Cements is showing signs of joining the party.

According to Finpire, a solid base has formed at ₹760, and a breakout above ₹818 could spark a fresh wave of momentum. They recommend a near-term target of ₹1200.

Data on Stocktwits shows retail sentiment is 'neutral' with low message volume.

Deccan Cements stock has gained 24% year to date (YTD).

3. Gabriel India

According to Finpire, Gabriel India has decisively closed above a major supply zone, with bullish RSI confirmation and a volume spike to match.

They add that if the stock sustains over ₹575, it could test multi-month highs.

The analyst believes one can look to enter now and that the stock could head toward ₹850–₹900 in the coming weeks.

The auto ancillary company recently posted robust fourth-quarter earnings, with profit rising 45% to ₹60 crore and sales rising 25% to ₹1,016 crore.

Data on Stocktwits shows retail sentiment is 'neutral' with low message volume.

Gabriel India stock has gained 22% year to date (YTD).

4. Krishna Institute of Medical Sciences (KIMS)

The analyst highlights that the RSI is hovering above 70, and the recent volume surge confirms strong interest.

The Telangana-based multi-specialty hospital chain sees benefits from expansion into tier-2 cities and its recent deal with Wipro GE Healthcare for advanced medical tech.

Finpire recommended adding at the current market price with targets of ₹1000–₹1050.

Data on Stocktwits shows retail sentiment is 'neutral' with low message volume.

KIMS stock has gained 13% year to date (YTD).

5. SBFC Finance

This NBFC stock hit a 52-week high on Wednesday.

According to Finpire, SBFC Finance recently broke out cleanly above ₹105 on high volumes, with RSI soaring to 78.

They recommended using a staggered entry strategy—initiate with a small quantity now and add more once it makes a new base. Short-term targets sit at ₹140–₹150.

Data on Stocktwits shows retail sentiment is 'neutral' with normal message volume.

SBFC stock has gained 19% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)