Advertisement|Remove ads.

Fifth Third Bancorp Stock Falls After Earnings Miss Estimates: Retail Neutral

Fifth Third Bancorp’s stock ($FITB) was down nearly 1.7% in pre-market trading after the company’s third-quarter earnings per share (EPS) and revenue missed Wall Street estimates. Retail sentiment, however, was neutral on Stocktwits.

Fifth Third posted $0.78 in EPS, below the $0.83 estimated by analysts. Its revenue stood at $2.13 billion, below the expected $2.16 billion.

Net income fell 13% to $573 million compared to the same period last year. Its net interest income fell 1% from a year-ago quarter to $1.43 billion.

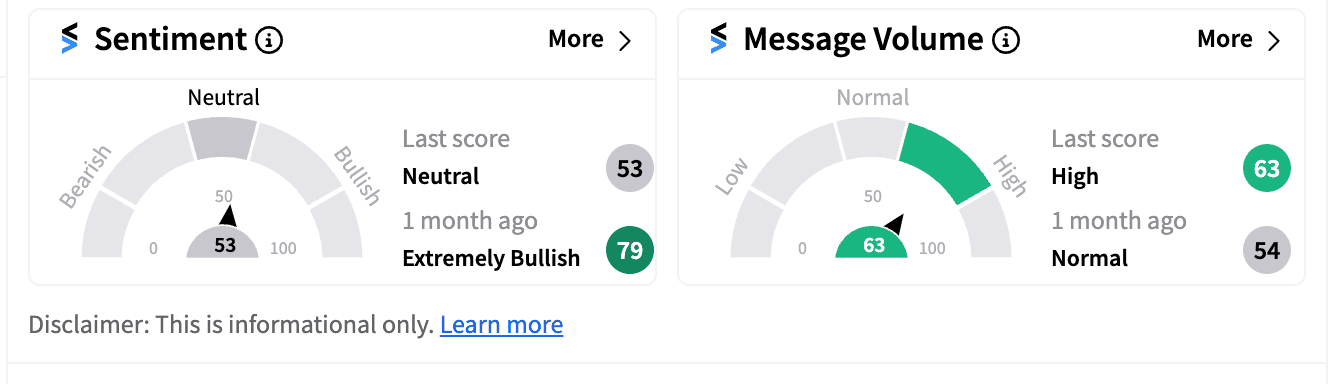

Retail sentiment was neutral (53/100) compared to ‘extremely bullish’ (79/100) a day ago. Message volume, meanwhile, was ‘high’. (63/100).

“With our strong core deposit franchise and liquidity, we are well positioned for the declining interest rate environment and volatility driven by the economic and regulatory uncertainty,” Tim Spence, Fifth Third Chairman, CEO and President, said in a statement.

“Our strategic growth priorities continue to deliver strong results. In the Southeast, where we are expanding into high-growth markets, deposits grew by 16% over the last twelve months.”

It increased its quarterly cash dividend on its common shares by $0.02, or 6%, to $0.37 per share for the third quarter of 2024, the company said.

The bank claims deposits grew by 16% in high-growth markets in the Southeast over the last 12 months.

Its wealth and asset management business also appear to be strong with assets under management growing 21% year-over-year to $69 billion.

Fifth Third stock is up 30.4% year-to-date.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)