Advertisement|Remove ads.

Apple, Microsoft, Google, Meta, Amazon: How’s Retail Feeling About These Big Tech Stocks Ahead Of Earnings This Week?

The “Magnificent Seven” earnings flow continues this week with increased momentum after Tesla, Inc. ($TSLA) warmed the Street with its better-than-expected quarterly results.

Earnings Season Expectations

The blended third-quarter earnings growth of S&P 500 companies is estimated at 3.6%, according to data compiled by financial data analytics company FactSet. If the estimate proves accurate, the profit growth streak may extend to six straight quarters, although the rate of growth will mark the smallest since the second quarter of 2023.

IT (15%) and communication services (11.5%) sectors are expected to lead in terms of profit growth, with eight of the 11 S&P 500 sectors priming to show positive earnings growth.

Wedbush analyst Daniel Ives is bullish about big tech earnings. “We believe the week ahead for Big Tech earnings will be strong and represents a key positive catalyst sending tech stocks higher into year-end,” he said in a note published Sunday.

Here’s a rundown on what to expect from these mega-cap companies and the retail sentiment toward stocks of these companies.

Alphabet, Inc. ($GOOGL) ($GOOG)

The parent of search engine giant Google is due to announce its quarterly earnings after the market close on Tuesday.

Analysts, on average, expect the company to report third-quarter earnings per share (EPS) of $1.84 and revenue of $86.4 billion. This compares to the year-ago quarter’s $1.55 and $76.69 billion, respectively.

In a note released last week, Wedbush analyst Scott Devitt said Wall Street’s estimates for third-quarter advertising growth is achievable but upside relative to estimates is unlikely. He attributed this lukewarm outlook to the results of Wedbush’s third-quarter ‘Digital Advertising Survey,” Skai commentary that pointed to decelerating Search growth and competitive headwinds for YouTube.

He models Google Search growth of 11.5% and YouTube ad growth of 11.5%.

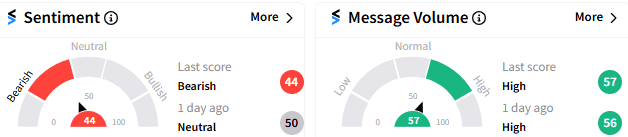

Retail sentiment on Alphabet has worsened to ’bearish' with a score of 44/100 on Stocktwits and message volume remained ‘high.’

Microsoft Corp. ($MSFT)

Redmond, Washington-based Microsoft is scheduled to report after the market closes on Wednesday. The consensus estimates call for fiscal-year 2025 first-quarter EPS of $3.10, up from $2.73 a year-ago, and revenue of $64.57 billion, representing 30% year-over-year growth.

Last week, Bernstein analyst Mark Moerdler nudged down the price target for Microsoft by a dollar to $500, according to the Fly. “The story is relatively well understood with the Street focused on Azure growth, whether the AI tailwind is happening, sustainability of Office 365 growth and margins,” he said.

Microsoft’s re-segmentation of its business has not been fully reflected in Wall Street’s consensus and this could create some noise, he added.

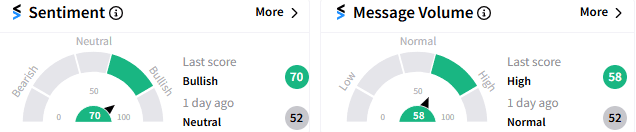

On Stocktwits, sentiment was ‘bullish’ (70/100), with ‘high’ message volume.

Meta Platforms, Inc. ($META)

Meta’s third-quarter earnings are scheduled for Wednesday after the market closes. The Mark Zuckerberg-led company’s third-quarter EPS is widely expected to increase from $4.00 a year ago to $5.21. Revenue may have climbed from $33.56 billion to $40.19 billion.

Bernstein bumped up Meta’s stock price target from $600 to $675 last week, citing the social-media giant’s growing, healthy core business, the Fly reported. The analyst called the company an “AI winner story with lower terminal risk, and a shareholder-friendly management team.”

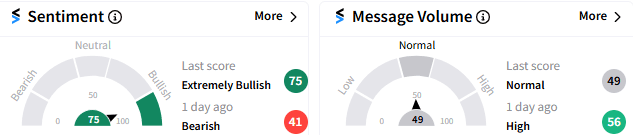

Meta has largely drawn ‘bullish’ sentiment from the retail crowd. (75/100).

Apple, Inc. ($AAPL)

Tech giant Apple will release its fiscal year 2024 fourth-quarter results after the market closes on Thursday. Analysts, on average, expect the company to report EPS of $1.52, up from $1.36 a year ago, according to Yahoo Finance. Revenue may have risen 13% to $94.47 billion.

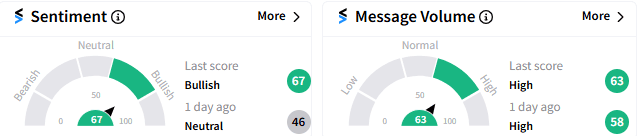

On Stocktwits, sentiment toward the stock was bullish (67/100) and message volume remained ‘high.’

Amazon, Inc. ($AMZN)

E-commerce giant Amazon’s earnings release has been scheduled for Thursday after the market closes.

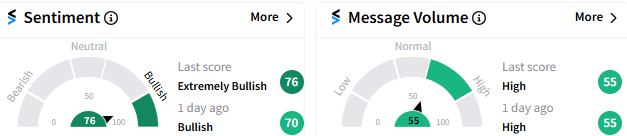

Sentiment on Stocktwits has been 'extremely bullish,' (76/100) and message volume was ‘high.’

The company is expected to grow its third-quarter earnings from $0.86 a year ago to $1.14. The consensus estimate for revenue is at $157.26 billion, up from $141.41 billion in the year-ago period.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)