Advertisement|Remove ads.

iCAD Stock Rockets On Merger Announcement With RadNet: Retail’s Elated

Shares of AI-powered breast health solutions provider iCAD, Inc. (ICAD) rocketed over 67% on Wednesday morning after the company said it entered a definitive merger agreement with RadNet (RDNT).

Diagnostic imaging services provider RadNet will acquire iCAD in an all-stock transaction where iCAD stockholders will receive 0.0677 shares of RadNet common stock for each share of iCAD common stock they hold at the closing of the merger.

Based upon RadNet’s closing price on Monday, this represents a transaction value of approximately $103 million, or approximately $3.61 per share of iCAD common stock on a fully diluted basis and an approximately 98% premium to iCAD stockholders based on iCAD’s closing stock price on Monday, the company said.

The transaction is expected to close in the second or third quarter of 2025, subject to approval by iCAD stockholders. It is expected to add to RadNet’s wholly-owned unit DeepHealth, an installed base of over 1,500 healthcare provider locations across over 50 countries.

RadNet CEO Howard Berger said that iCAD’s ProFound Breast Health Suite and RadNet’s DeepHealth AI-powered breast screening solutions together have the power to improve patient diagnosis of breast cancer.

“With over 1,500 healthcare provider locations, facilitating over eight million annual mammograms in 50 countries, iCAD’s installed base and strong sales, engineering, and marketing capabilities will provide us with immediate broad and valuable customer relationships and commercialization capabilities that can accelerate our existing DeepHealth objectives,” he said.

RadNet stock fell by about 7% on Wednesday.

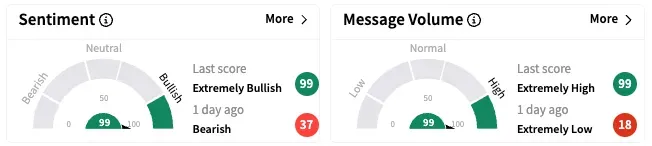

On Stocktwits, retail sentiment around iCAD rose from ‘bearish’ to ‘extremely bullish’ over the past 24 hours while message volume jumped from ‘extremely low’ to ‘extremely high’.

ICAD stock is up by over 62% year-to-date and has more than doubled over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_CEO_OG_jpg_7352181faa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)