Advertisement|Remove ads.

Ford Stock Rallies After-Hours As Tariff Relief, Novelis Restart Brighten 2025 Outlook For F-150 Trucks

- Ford said recent U.S. trade policy changes will cut its 2025 tariff headwind in half, easing cost pressure on its truck-heavy lineup.

- The automaker confirmed Novelis’s fire-hit aluminum plant will restart by late December, earlier than expected, supporting faster F-150 production recovery.

- The company said easing emissions rules could lower 2026 compliance costs, giving Ford more flexibility to balance gas, hybrid, and electric models.

Ford Motor shares rose in extended trading on Thursday after the automaker highlighted tariff relief and faster supply recovery following a fire at Novelis Inc.’s aluminum factory in New York that had disrupted production of its F-150 pickups and SUVs.

The stock rose 2.6% to $12.34 in after-hours trading on Thursday after closing 0.7% lower earlier in the day.

During the company’s post-earnings conference call, executives said recent U.S. trade policy changes will reduce Ford’s net tariff headwind for 2025 to about $1 billion from $2 billion. The updated policy rewards automakers for building more vehicles in the U.S. and makes competition fairer for larger trucks.

The company said expected changes to emissions rules could also ease some of Ford’s 2026 regulatory costs, giving it more room to adjust its mix of gas, hybrid, and electric models based on demand.

Ford Q3 Earnings Review

Ford posted third-quarter (Q3) revenue of $50.5 billion, up 9% from a year earlier, and adjusted earnings per share of $0.45, beating Koyfin analyst estimates of $0.36. Adjusted EBIT stood at $2.6 billion, matching last year’s figure despite higher input costs and supply disruptions.

The automaker trimmed its full-year adjusted EBIT forecast to $6 billion–$6.5 billion, down from prior guidance of $6.5 billion–$7.5 billion, while maintaining capital expenditure plans of about $9 billion. CFO Sherry House said on the call that Ford would have raised guidance if not for the supplier fire, noting the company had been tracking at $8 billion-plus in adjusted EBIT before the incident.

Novelis Fire And Recovery Plans

Ford said the September fire at the Novelis plant will cut adjusted profit this year by $1.5 billion to $2 billion, though it expects to offset at least $1 billion of that impact in 2026. CEO Jim Farley said he had visited the site and worked with Novelis to source aluminum from unaffected areas. “We have made substantial progress in a short time to minimize the impact in 2025 and recover production in 2026,” he said.

Novelis said it will restart the affected line by late December, faster than its earlier projection of early 2026.

Ford plans to increase F-150 and Super Duty output by 50,000 units in 2026 to recover about half of this year’s lost production and will hire 1,000 workers at plants in Michigan and Kentucky. A third shift will also be added at the Dearborn F-150 plant. Production of the all-electric F-150 Lightning remains paused as Ford prioritizes more profitable gasoline and hybrid versions.

Segment Performance

Ford Pro, its commercial division, reported $2 billion in EBIT, up from $1.8 billion a year earlier. The traditional Ford Blue unit earned $1.5 billion, while the Model e electric-vehicle division posted a $1.4 billion loss amid continued pricing pressure in the EV market.

Stocktwits Traders Eye Rebound

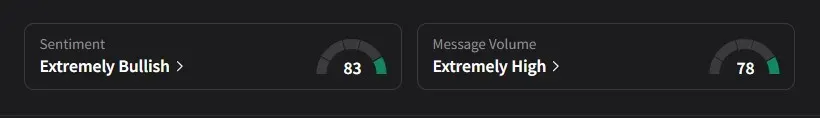

On Stocktwits, retail sentiment for Ford was ‘extremely bullish’ amid a 358% surge in 24-hour message volume.

One user said they expect Ford’s stock to dip toward the low $12 range, possibly after Monday’s dividend payout, before rebounding to between $13 and $14 over the next month or two.

Another bullish user predicted a steady climb back into the $20s.

Ford’s stock has risen 32% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)